The resolution of Disney’s proxy battle on Wednesday isn’t likely to resolve the company’s challenges in the streaming arena. But first…

The ongoing saga of Walt Disney Co.’s confrontation with activist investors raises questions about who plays the hero and who takes the role of villain.

Answers may emerge on Wednesday during the company’s annual shareholder meeting, where investors will cast their votes on an activist-led campaign to restructure the board.

At the heart of the conflict lies Disney’s streaming segment. Despite rapid growth since its 2019 launch — encompassing Disney+, ESPN+, and Hulu — the division posted an operating loss of $216 million in the quarter ending December.

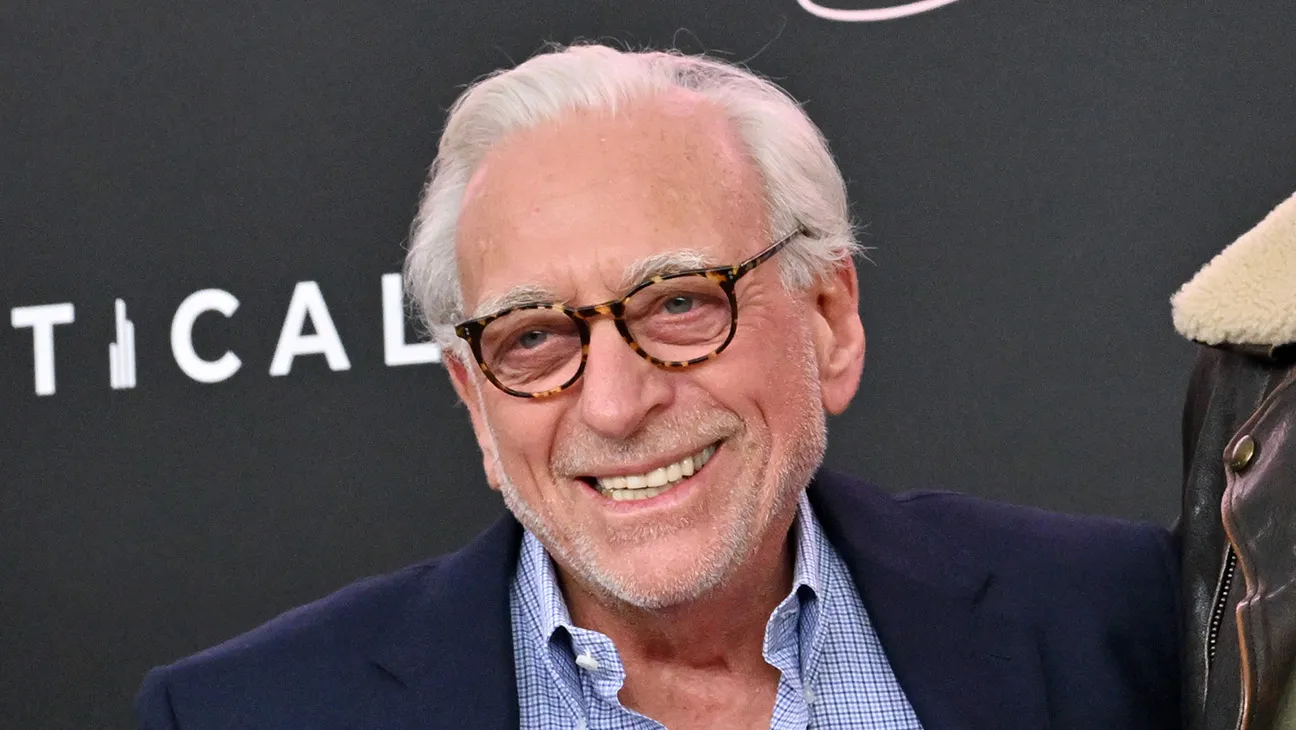

The shift of consumers from cable TV to streaming platforms for on-demand entertainment has been ongoing. However, the performance of Disney’s streaming services is a key concern for activist investor Trian Partners, led by Nelson Peltz.

In a detailed 133-page manifesto published on March 4, Peltz criticizes Disney’s streaming strategy for being belated and poorly planned.

He questions the wisdom of the Fox acquisition, which, at $71 billion, he believes overexposed Disney to the declining linear TV business.

Peltz is perplexed by the continued losses in a segment generating over $22 billion in annual revenue.

He’s critical of Disney’s approach, which he perceives as raising prices and cutting content production costs to drive profitability, potentially at the expense of subscriber growth.

Should Peltz secure a board seat, his proposals center on reducing Disney’s exposure to traditional TV by seeking partnerships and formulating a digital strategy for ESPN. Succession planning for Iger, who extended his tenure last year, is also a priority.

The battle’s outcome remains uncertain, though recent developments seem to favor Iger. He’s garnered support from influential figures like Star Wars creator George Lucas and Jamie Dimon of JPMorgan Chase. Peltz, meanwhile, enjoys backing from some prominent advisory firms.

Iger has taken steps to address broader investor concerns. A longstanding dispute with Florida and its governor concluded recently, and in February, Disney collaborated with Fox Corp. and Warner Bros. Discovery Inc. to launch a sports streaming service.

Additionally, Disney invested $1.5 billion in Epic Games, granting the Fortnite maker access to its intellectual properties.

However, Peltz remains unsatisfied. Perhaps because his fundamental question remains unanswered: How does Disney make its streaming business profitable without compromising content quality?

Leave a Reply