Ever since Congress passed a bill compelling the Chinese company ByteDance to either sell or shut down TikTok, a major question has been who could buy it, considering the technological, political, and financial implications involved.

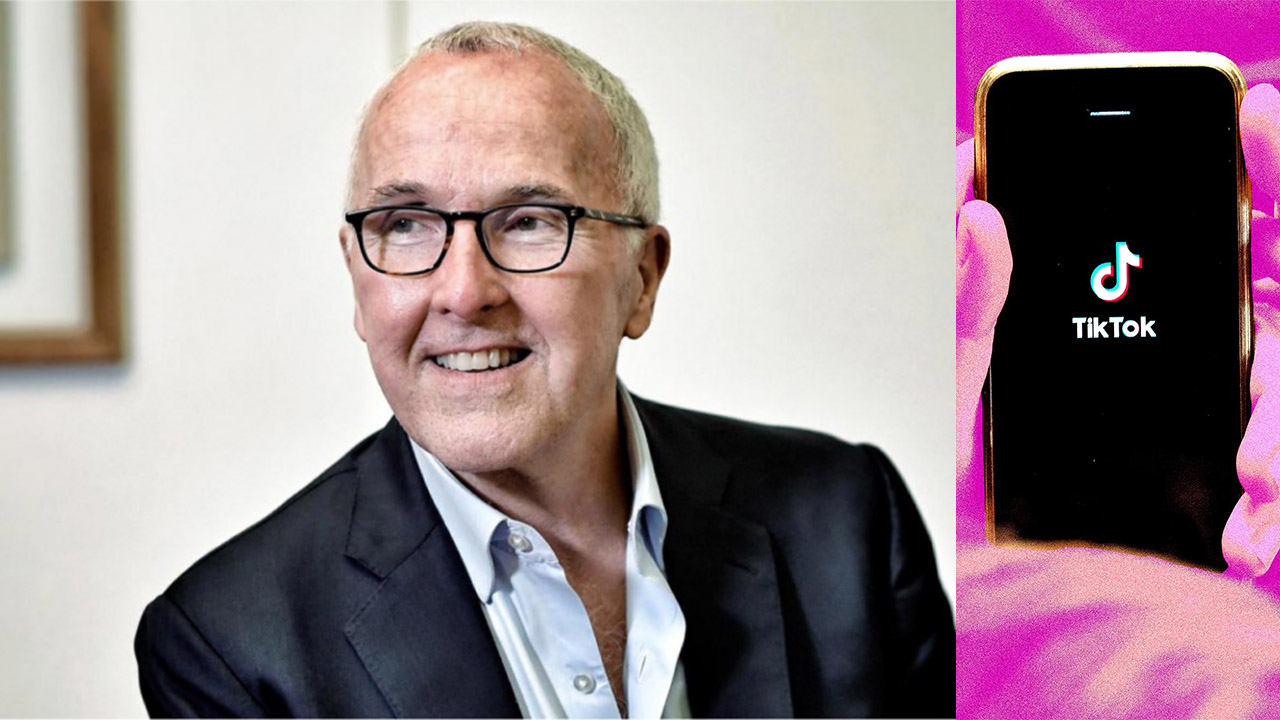

Billionaire Frank McCourt has expressed his interest.

On Wednesday, Mr. McCourt announced that he is working to assemble a group of bidders to purchase the social media app. His aim is to reconsider how TikTok, and the internet as a whole, use data and address privacy issues.

He is already in discussions about the app with academics and technology impact researchers, including Jonathan Haidt, whose book “The Anxious Generation” on the effects of smartphones on adolescent mental health has been a best-seller for over a month.

Mr. McCourt, a former owner of the Los Angeles Dodgers who amassed his fortune in real estate, has long been concerned with the intersection of technology and society.

He has been campaigning to redesign the internet and shift control of user data away from tech giants like Facebook and TikTok. In 2021, he launched an initiative called Project Liberty to focus on these efforts.

“This seemed like a great opportunity to actually create the alternative to the current internet, which has been colonized by large platforms including TikTok,” Mr. McCourt stated in an interview. He believes the deal could enable users to “control their identity, own and control their data.”

Whether ByteDance can find a buyer for TikTok will be crucial in determining its future in the United States: failure to do so could result in its shutdown.

However, selling TikTok would be prohibitively expensive, narrowing the pool of potential buyers. Most large technology companies would likely face antitrust scrutiny if they attempted to acquire the app.

Despite these challenges, interest in one of the world’s most popular social media applications remains high.

Steven Mnuchin, a former Treasury secretary, made headlines in March by stating he was “trying to put together a group to buy TikTok, because they should be owned by U.S. businesses.” TikTok’s U.S. investors include the Susquehanna Investment Group and General Atlantic.

Mr. McCourt’s bid is still in its nascent stages. He has not disclosed all the parties he has consulted regarding the purchase or specified where he would obtain the capital for the offer.

There remain many uncertainties about what a TikTok sale might entail. The Chinese government has the authority to block the sale of TikTok’s valuable algorithm, and separating TikTok’s U.S. operations from those of its parent company, ByteDance, could be complex.

Given this uncertainty, Mr. McCourt stated it was too early to discuss a potential valuation. Nevertheless, he is interested in TikTok even without its video recommendation technology and has already enlisted financial advisers from Guggenheim Securities and legal advisers from Kirkland & Ellis.

“We doubt very much that China would sell TikTok with the algorithm,” Mr. McCourt noted. “We’re the one bidder that doesn’t want the algorithm because we’re talking about a different architecture, a different way of thinking about the internet and how it operates.”

He emphasized the value in TikTok’s large user base, its content, its brand, and “a lot of technology short of the algorithm.”

In April, President Biden signed the new law, which swiftly passed through Congress after nearly a year of closed-door proceedings. Lawmakers and intelligence officials have raised increasing concerns about TikTok posing a national security threat.

The company sued the federal government last week and is also funding a separate legal challenge from TikTok creators, arguing that it has spent billions to address security concerns and that the law violates the First Amendment.

Leave a Reply