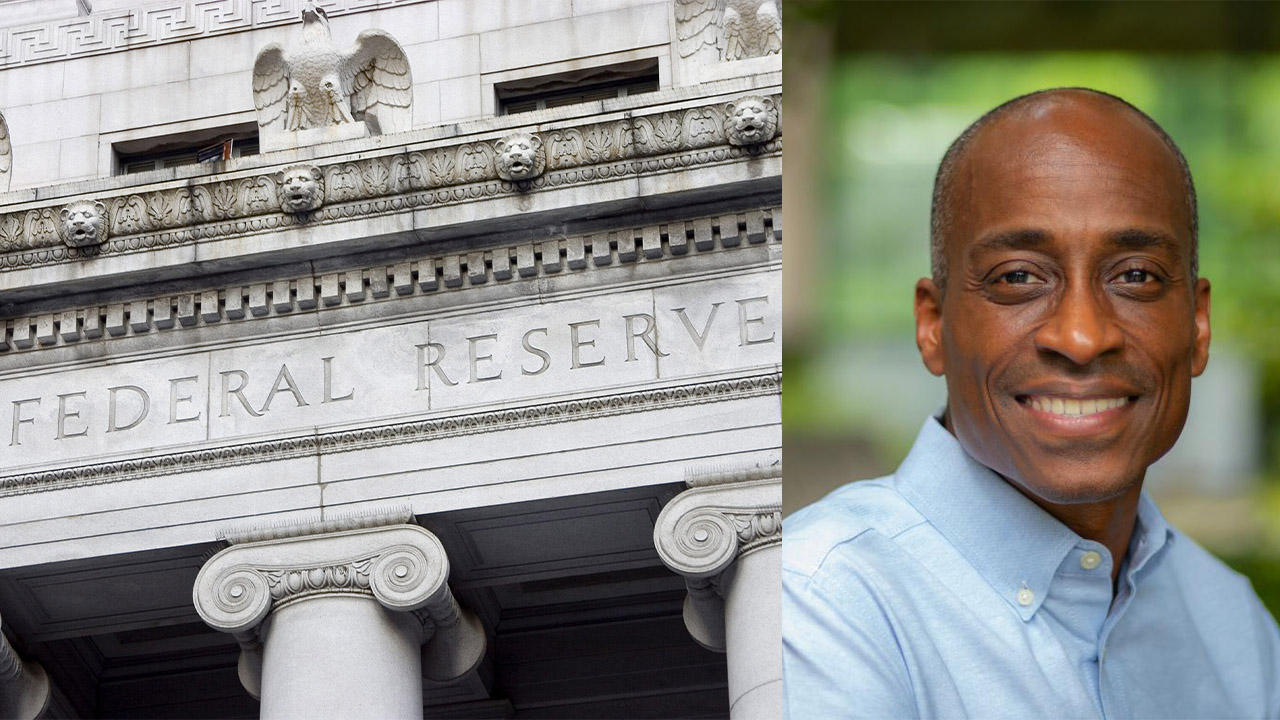

Federal Reserve vice chair Philip Jefferson echoed the sentiments of other central bank officials by advocating for maintaining current interest rates until there are clearer signs of inflation easing.

During a Q&A session at the Cleveland Fed, Jefferson emphasized the need for additional evidence indicating a return to the Fed’s 2% inflation target before considering any adjustments to the policy rate.

Jefferson attributed his shift in stance to the higher inflation data observed in the first quarter. The Fed’s benchmark interest rate, set at a range of 5.25%-5.50%, remains at a 23-year high following the decision on May 1.

The upcoming policy meeting on June 12 is expected to see rates held steady once again.

In its recent policy statement, the Fed highlighted the lack of progress toward achieving the Committee’s inflation objective of 2%.

The release of the Consumer Price Index (CPI) this week, providing the first inflation reading for the second quarter, offers an opportunity for further insights.

The CPI for April is anticipated to indicate improvement, with a projected decrease to 3.6% from March’s 3.8% on a “core” basis, excluding volatile food and energy prices.

Various Fed officials reiterated their cautious approach to monetary policy in light of higher-than-expected inflation in the early part of the year.

New York Fed president John Williams expressed confidence in the current policy stance, while Minneapolis Fed president Neel Kashkari suggested a likelihood of maintaining the status quo for an extended period.

Chicago Fed president Austan Goolsbee emphasized a stance of waiting for further developments.

Leave a Reply