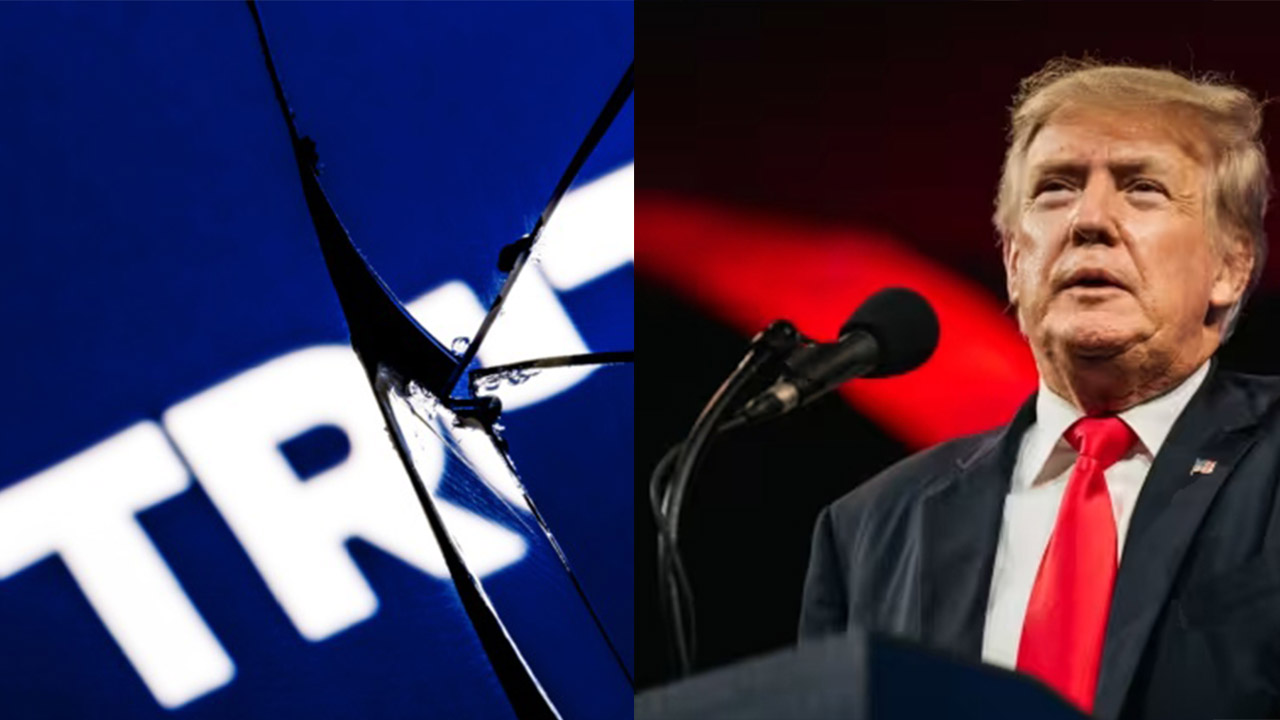

Trump Media shares experienced a significant decline on Wednesday, dropping by over 9.5%. Trading under the DJT ticker, Trump Media closed at $45.16 per share, marking a loss of $4.77 per share.

Despite its initial public trading debut on March 26 at over $70 per share, the company, which owns the Truth Social app, continues to trade below its peak.

In a regulatory disclosure on Tuesday, Trump Media confirmed that former President Donald Trump was granted an additional 36 million shares in an earnout bonus.

This windfall occurred as the share price remained above $17.50 for 20 trading days since its public debut, adding to Trump’s existing stake of more than 78 million shares.

Currently holding 65% of the company’s shares, Trump’s stake is valued at $5.7 billion based on a share price of $50. However, he is restricted from selling these shares for six months following the execution of Trump Media’s merger with Digital World Acquisition Corp. in late March.

Trump Media’s CEO, former Republican congressman Devin Nunes, has raised concerns about potential market manipulation by short sellers.

The company has urged shareholders to take measures to prevent their stock from being loaned for short-selling trades.

According to Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, short interest in DJT shares exceeds $147 million, with 3.55 million shares shorted.

Borrow fees for short-sell trades are sharply rising, reaching nearly 300% for existing shorts and 600% for new stock borrows.

While short selling in Trump Media increased at the start of the year when it traded under the DWAC ticker, there has been a recent trend of covering short positions.

Dusaniwsky noted a decline in total shares shorted over the last thirty days, resulting in a significant reduction in short sellers’ mark-to-market profits.

The high stock borrow costs have led to losses for some short sellers, prompting expectations of further short covering if DJT’s stock price remains high.

Leave a Reply