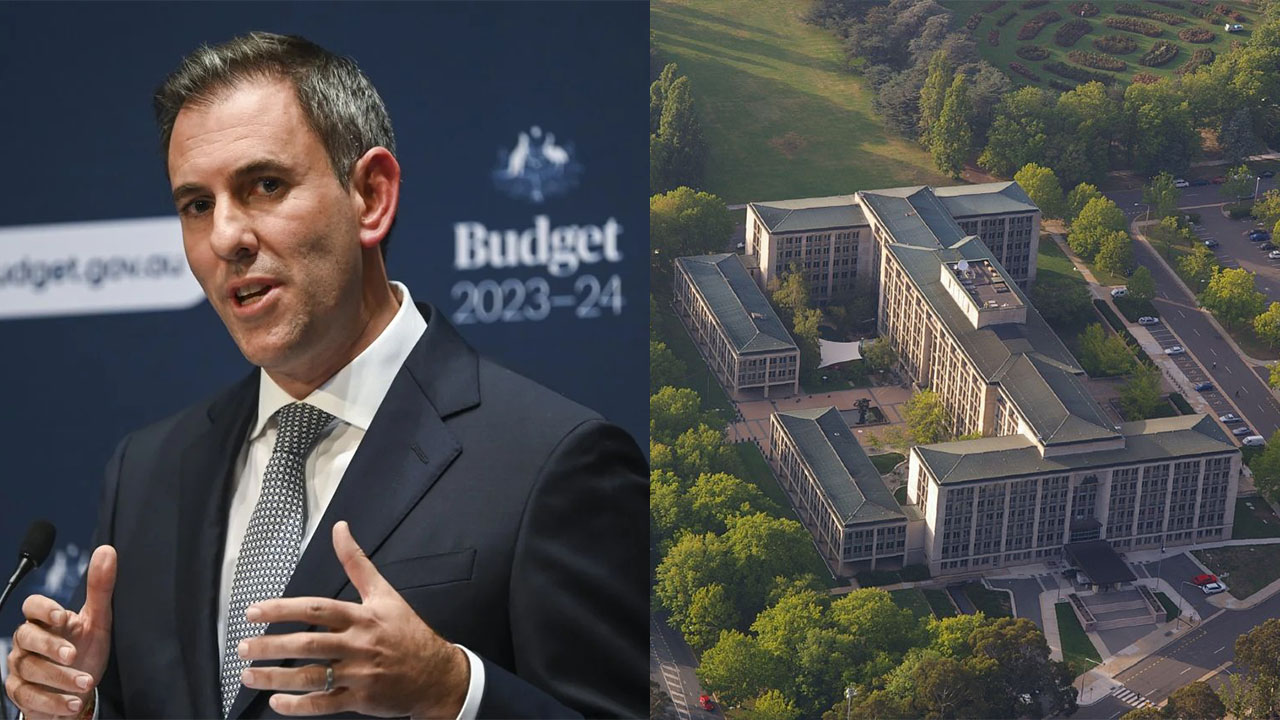

Australia’s Treasurer, Jim Chalmers, has revealed plans for the nation’s budget, emphasizing a significant boost to the critical minerals industry, which he dubs a “golden opportunity” in the run-up to the release of the annual fiscal blueprint.

In an interview in Canberra on Sunday, Chalmers highlighted the importance of the critical minerals sector, drawing attention from both global and domestic investors. He stressed the need to attract and utilize investments effectively in this lucrative market.

The Treasurer is set to present the budget on Tuesday night, aiming to strike a delicate balance between addressing persistent high inflation in the short term and fostering Australia’s economic prospects in the long run.

Australia’s critical minerals industry forms a crucial component of the government’s strategy to leverage the global green energy revolution.

With major powers such as the US eyeing Australian battery minerals to reduce reliance on Chinese supply, the industry’s significance has grown. These minerals are integral to the production of solar panels, electric vehicles, and lithium-ion batteries.

At the core of the budget lies the center-left Labor government’s Future Made in Australia program, aimed at stimulating high-tech and green manufacturing akin to the US’s Inflation Reduction Act.

While specifics are yet undisclosed, Chalmers indicated that the policy would incorporate a mix of tax incentives, targeted grants, and frameworks to attract and deploy private investment.

Unlike the expansive government spending seen in the US, Australia’s approach will focus on complementing, rather than replacing, private investment, leveraging the nation’s inherent strengths as an investment destination.

The government has already committed A$566 million ($374 million) to boost resource exploration, with a particular emphasis on critical minerals. Chalmers hinted at further support in this regard.

Despite the prospect of a second consecutive surplus in the budget, driven by an anticipated A$11 billion windfall, Australia faces challenges, including a weaker outlook for its largest trading partner, China.

While the budget forecasts China’s GDP growth to hover between 4% to 5%, there are uncertainties with potential stimulus measures in the Chinese economy.

Acknowledging Australia’s reliance on the Chinese economy, Chalmers sees opportunities for diversification, highlighting the growth potential in fast-growing ASEAN markets as an alternative avenue for trade and growth.

Leave a Reply