Rubrik, a data management software provider, saw a notable surge in its debut on the New York Stock Exchange on Thursday, underscoring investors’ growing appetite for tech initial public offerings.

Opening at $38.60 per share, the Microsoft-backed company priced its IPO at $32 per share on Wednesday, surpassing its anticipated range of $28 to $31 per share.

By the close of trading on Thursday, Rubrik’s stock had risen by 16% to $37 per share.

The company raised $752 million by selling 23.5 million shares, resulting in a valuation of $5.6 billion. Trading under the ticker symbol “RBRK,” Rubrik’s successful IPO marks a significant milestone.

In recent years, concerns about a weakening economy dampened investor enthusiasm for unprofitable companies, leading to a slowdown in tech IPOs. However, there are signs of a shift. Reddit and Astera Labs, a data center connectivity chip manufacturer, went public in March.

Founded a decade ago, Rubrik reported a net loss of $354 million in its latest fiscal year, compared to a $278 million loss in the preceding year. Notably, the company’s revenue from subscriptions has surged to 91%, up from 59% two years ago.

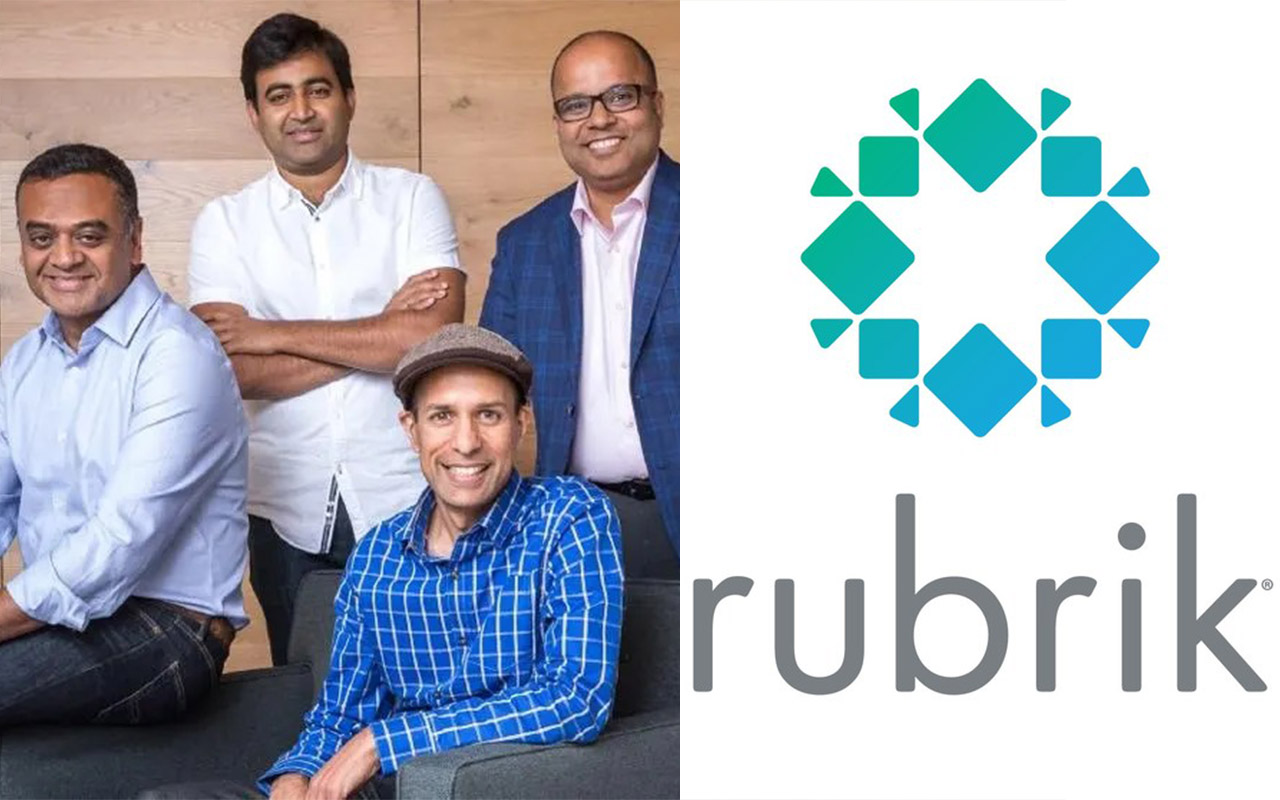

Microsoft’s investment in Rubrik in 2021 underscored confidence in the company’s potential. Rubrik’s co-founder and CEO, Bipul Sinha, maintains an 8% ownership stake, while Lightspeed Venture Partners, where Sinha previously served as a startup investor, holds 25% of the voting power.

Sinha emphasized Rubrik’s readiness for the public market, stating, “When we see the market is receptive and we were ready, we go.”

According to Ravi Mhatre, managing director at Lightspeed Venture Partners, the timing of an IPO is typically decided six to eight weeks in advance, with input from bankers and investors playing a crucial role.

Sinha’s interactions with public market investors provided valuable insights into their interests and preferences.

“Folks are looking for strong companies to go public, companies that have the potential to be a durable business, a moat in the marketplace, has something unique to offer in the marketplace and clearly winning in the marketplace,” Sinha remarked. “Staying public is the key, not going public.”

Leave a Reply