Bitcoin’s highly anticipated ‘halving’ looms, opinions diverge on its significance: some view it as a pivotal event enhancing Bitcoin’s value as a scarce asset, while others dismiss it as a mere technical adjustment hyped by speculators.

With Bitcoin recently reaching a record high of $73,803.25 in March, the impending halving has stirred curiosity and debate within the cryptocurrency community.

So, what exactly is the halving, and why does it matter? The halving, occurring approximately every four years, is a fundamental change in Bitcoin’s blockchain technology aimed at reducing the rate of new Bitcoin creation.

Envisioned by Satoshi Nakamoto, Bitcoin’s mysterious creator, the halving is encoded into the blockchain to enforce a capped supply of 21 million tokens.

With around 19 million tokens already in circulation, the halving slashes the rate of new Bitcoin issuance, impacting the rewards received by miners who maintain the blockchain through complex mathematical computations.

The Implications of Bitcoin’s Technical Shift Amidst Market Speculation

Blockchain mining, the process by which new blocks of transactions are added to the chain, forms the backbone of Bitcoin’s decentralized network.

Miners, utilizing computational power, compete to solve cryptographic puzzles and are rewarded with newly minted Bitcoin. The halving occurs every 210,000 blocks, effectively halving the rewards for miners and slowing the pace of new Bitcoin creation.

Proponents of Bitcoin’s scarcity argue that it inherently drives value, with limited supply leading to increased demand and, subsequently, higher prices. However, skeptics question this narrative, suggesting that market dynamics and speculation play a more significant role in determining Bitcoin’s price trajectory.

Additionally, the opacity of the cryptocurrency mining sector adds uncertainty, as the behavior of miners and their impact on market supply remains elusive.

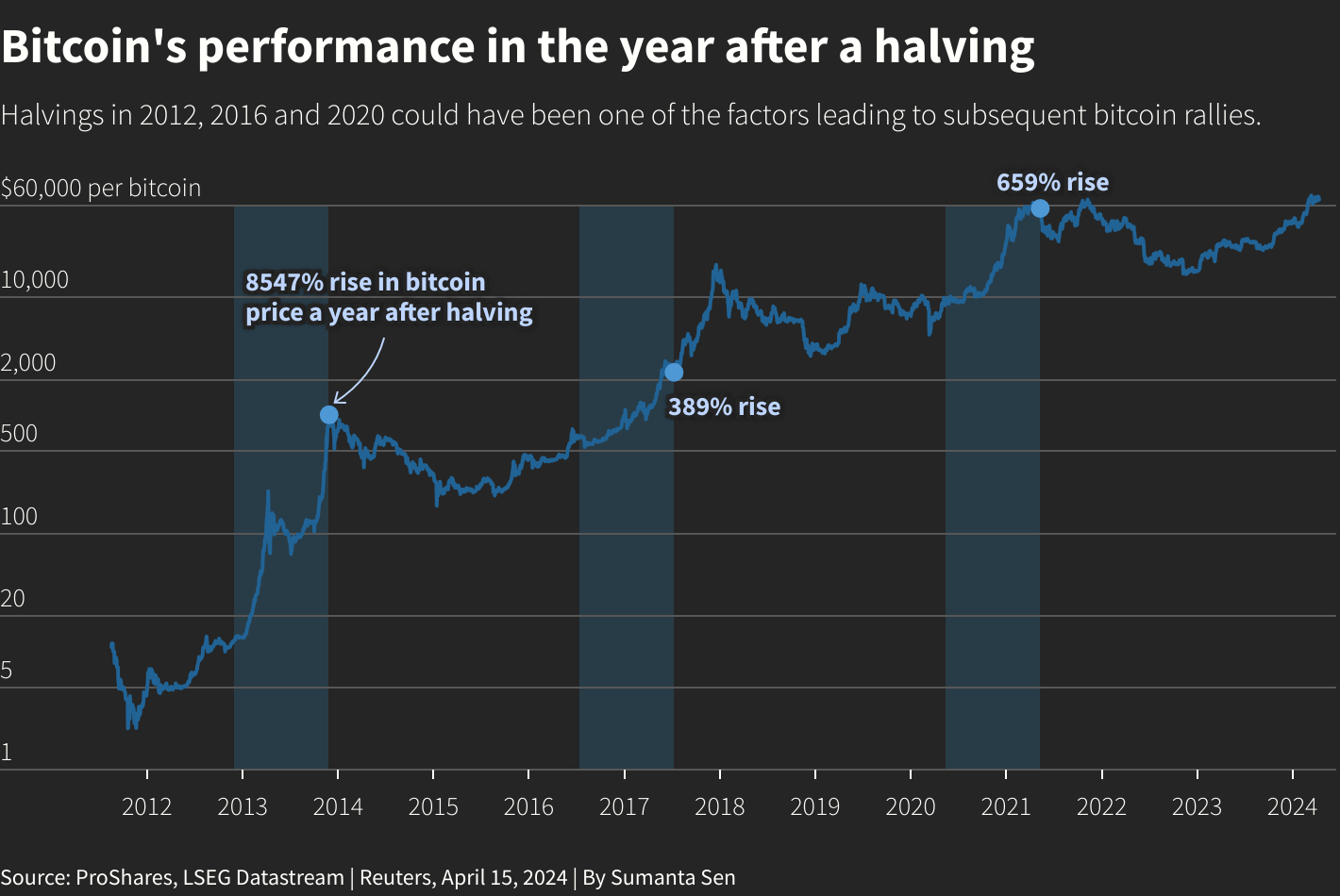

Past halving events have sparked speculation and analysis, yet conclusive evidence linking halvings to subsequent price surges is scarce.

While some attribute Bitcoin’s price movements to factors like loose monetary policies and retail investor activity, the influence of halving events remains ambiguous.

As the cryptocurrency market braces for the upcoming halving, regulators caution against the speculative nature of Bitcoin trading, emphasizing the potential risks posed to investors.

In a scenario fueled by speculation and market narratives, the true impact of Bitcoin’s halving remains shrouded in uncertainty, leaving traders and analysts to decipher its implications amidst the volatility of the cryptocurrency market.

Leave a Reply