Amidst a backdrop of muted loan growth and increased deposit costs, Wall Street analysts foresee ongoing pressure on the profitability of mid-sized banks in the United States throughout 2024.

Recent reports from Regions Financial, Huntington Bancshares, and Fifth Third Bancorp indicate smaller first-quarter profits, largely attributed to a significant decline in interest income.

Shares of Regions Financial and Huntington saw declines in morning trading, reflecting investor concerns over the challenging operating environment.

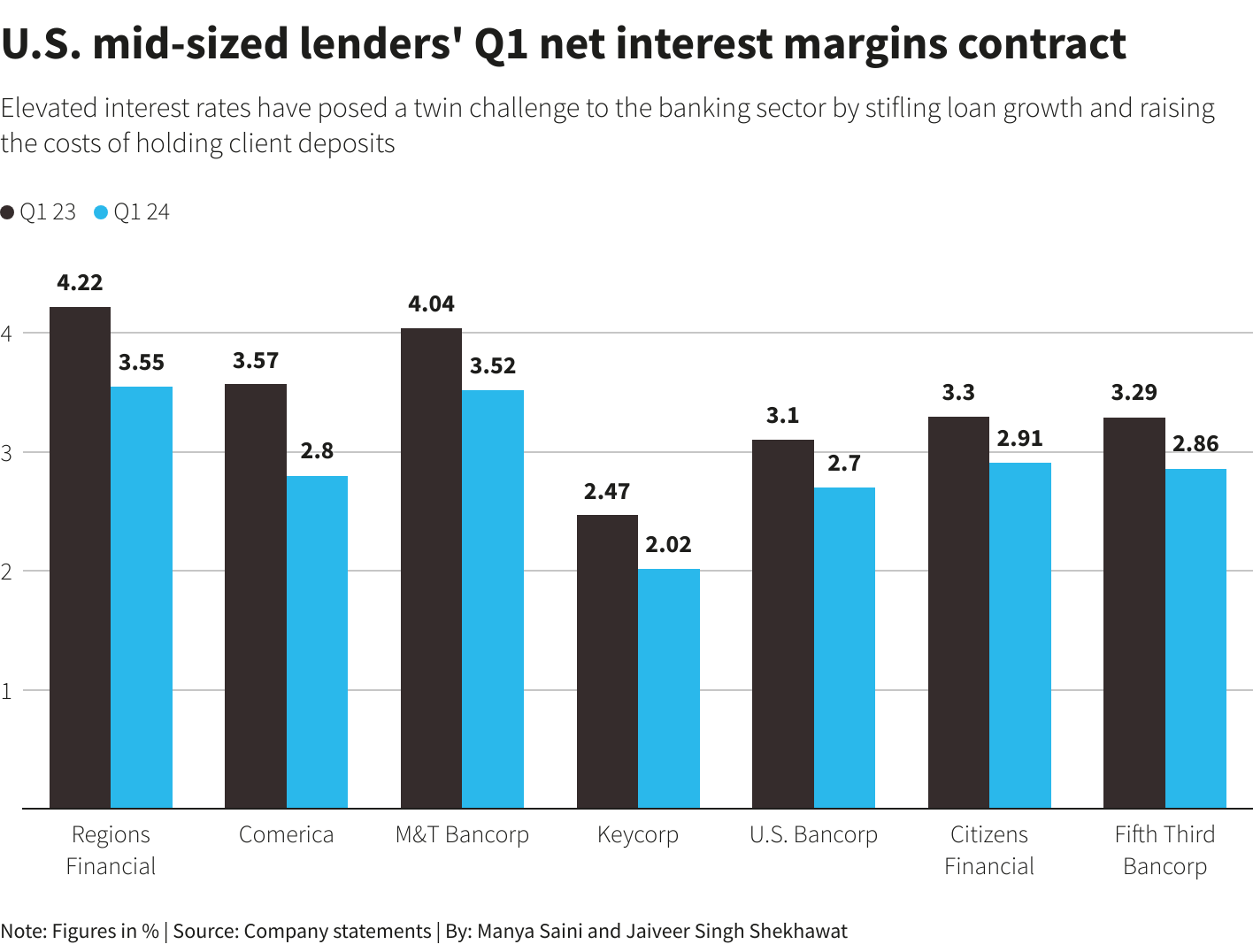

Despite Fifth Third’s earnings beat, the broader trend of diminishing net interest margins persists across regional lenders for the second consecutive quarter.

U.S. mid-sized banks’ profits would remain under pressure for most of 2024

Analysts caution that 2024 could prove troublesome for small to medium-sized banks, citing intense competition for deposits, economic conditions, and sluggish loan growth as key factors.

Larger banks are perceived to have an advantage due to their perceived stability and ability to offer a wider range of services.

Many mid-sized US banks anticipate a decline in net interest income for the year, as persistently high interest rates dampen loan activity and increase deposit costs.

Analysts note the need for a downward trajectory in interest rates to stimulate loan growth and restore profitability.

While some banks have adjusted their outlooks for the year, concerns persist regarding the broader impact of a prolonged period of increased interest rates. The prospect of higher borrowing costs and tepid loan demand continues to weigh on industry sentiment.

Efforts to mitigate the impact on profits include cost-cutting measures and strategic expense management. However, challenges persist as the industry grapples with a sluggish economic recovery and uncertain interest rate environment.

The pressure on profitability has translated into underperformance in industry stocks, with the KBW Regional Banking Index experiencing a notable decline this year compared to the broader market.

Mid-sized US banks face an uphill battle as they ongoing headwinds in the form of subdued loan growth and increased deposit costs.

While efforts are underway to mitigate these challenges, the path to sustained profitability remains uncertain amidst a backdrop of economic uncertainty and fluctuating interest rates.

Leave a Reply