Looking through recent economic fluctuations has proven to be a rollercoaster ride, leaving even seasoned observers feeling dizzy.

The past two weeks alone have seen a mix of positive and concerning indicators: a drop in the unemployment rate, a rise in inflation, and volatile movements in the stock market.

However, zooming out reveals a clearer perspective on the economy.

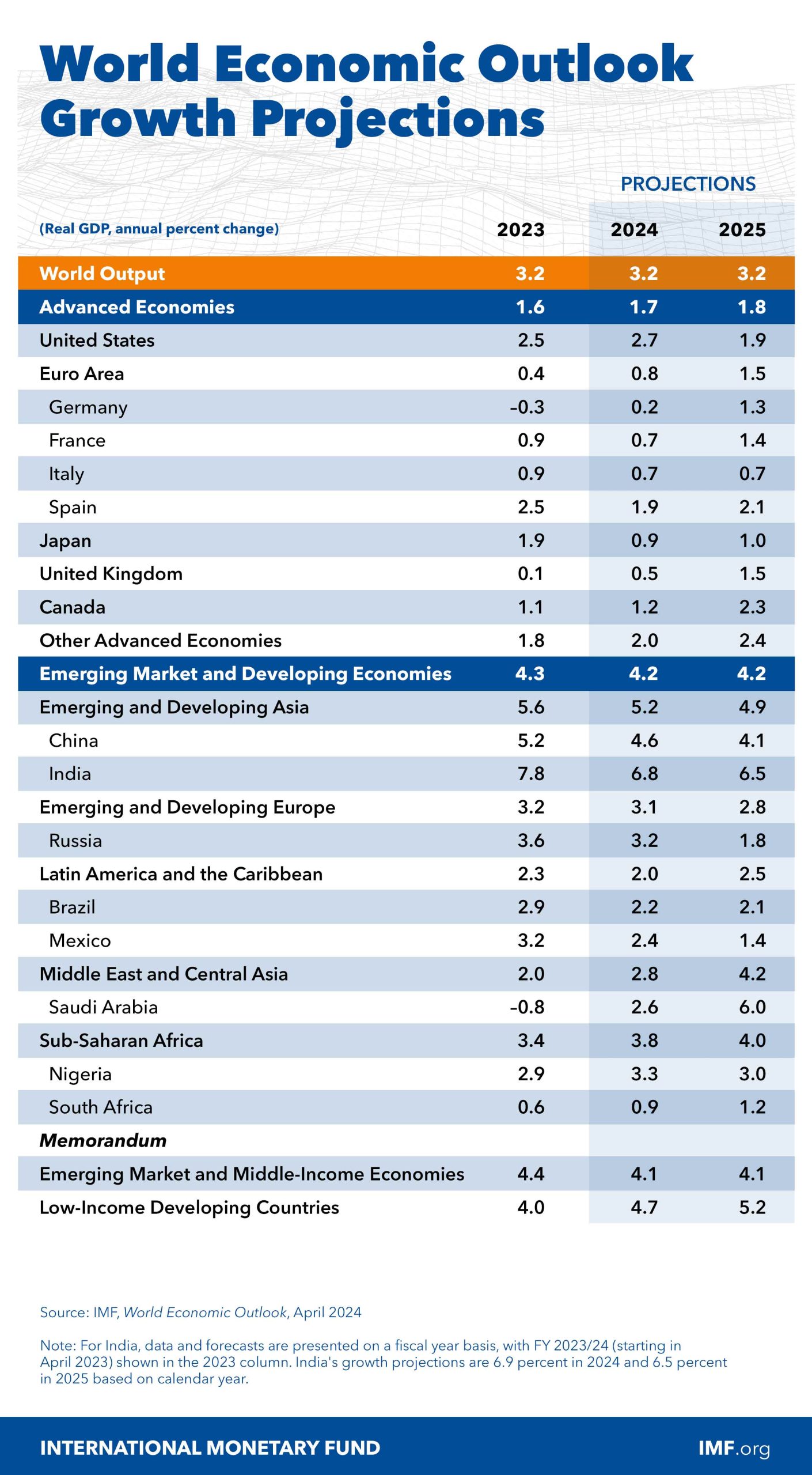

Understanding the Complex Dynamics of Inflation, Growth, and Resilience in Today’s Economy

Compared to the optimistic outlook of December, where the economy appeared to be smoothly gliding towards a “soft landing,” recent developments have been somewhat disappointing. Inflation has proven more persistent than anticipated, with interest rates expected to remain high for the foreseeable future.

Yet, when comparing the current situation to the forecasts from the beginning of last year, a more positive narrative emerges.

Back then, fears of a looming recession loomed large, fueled by concerns over inflation control measures by the Federal Reserve. Despite recent inflationary pressures, the economy has largely avoided significant damage, defying earlier predictions.

While monthly fluctuations in consumer prices and job growth are closely monitored by investors, the longer-term economic trajectory offers more insight.

Despite inflation’s stubbornness, it hasn’t surged uncontrollably. In specific categories, such as groceries and durable goods, inflationary pressures have eased, offering a glimmer of hope.

Moreover, beyond inflation, the broader economic indicators paint a reassuring picture. Job growth remains robust, unemployment rates are historically low, and wages continue to rise, albeit at a more sustainable pace.

Consumer spending remains resilient, driving economic growth, while sectors like construction and manufacturing show signs of recovery.

However, the persistence of high interest rates poses challenges for borrowers, particularly in the housing and credit markets.

Despite concerns about the potential strain on certain segments of the population, such as younger borrowers, the economy as a whole has weathered the impact of tighter monetary policy relatively well.

Moving forward, maintaining a balance between controlling inflation and sustaining economic growth remains paramount. While challenges persist, the current economic resilience offers a sense of optimism amidst the uncertainty.

Leave a Reply