Chinese and Hong Kong stocks have experienced a staggering decline, shedding approximately $4.8 trillion in market capitalization since 2021, surpassing the total value of the Indian stock market, according to HSBC.

This downturn does not bode well for either China or Hong Kong, especially when juxtaposed with the National Stock Exchange of India’s upward trajectory during the same period.

The NSE has surged ahead, surpassing the Hong Kong Stock Exchanges and Clearing to become the world’s fourth-largest exchange in January.

Data from the World Federation of Exchanges indicates that all listed stocks on the NSE amount to a combined $4.63 trillion, positioning it as the third-largest in Asia.

This stark contrast highlights the significant traction Indian stocks have gained in recent years, contrasting with the downturns witnessed in both China and Hong Kong.

China’s CSI 300 index has seen a decline for three consecutive years, with a drop of 11.4% last year.

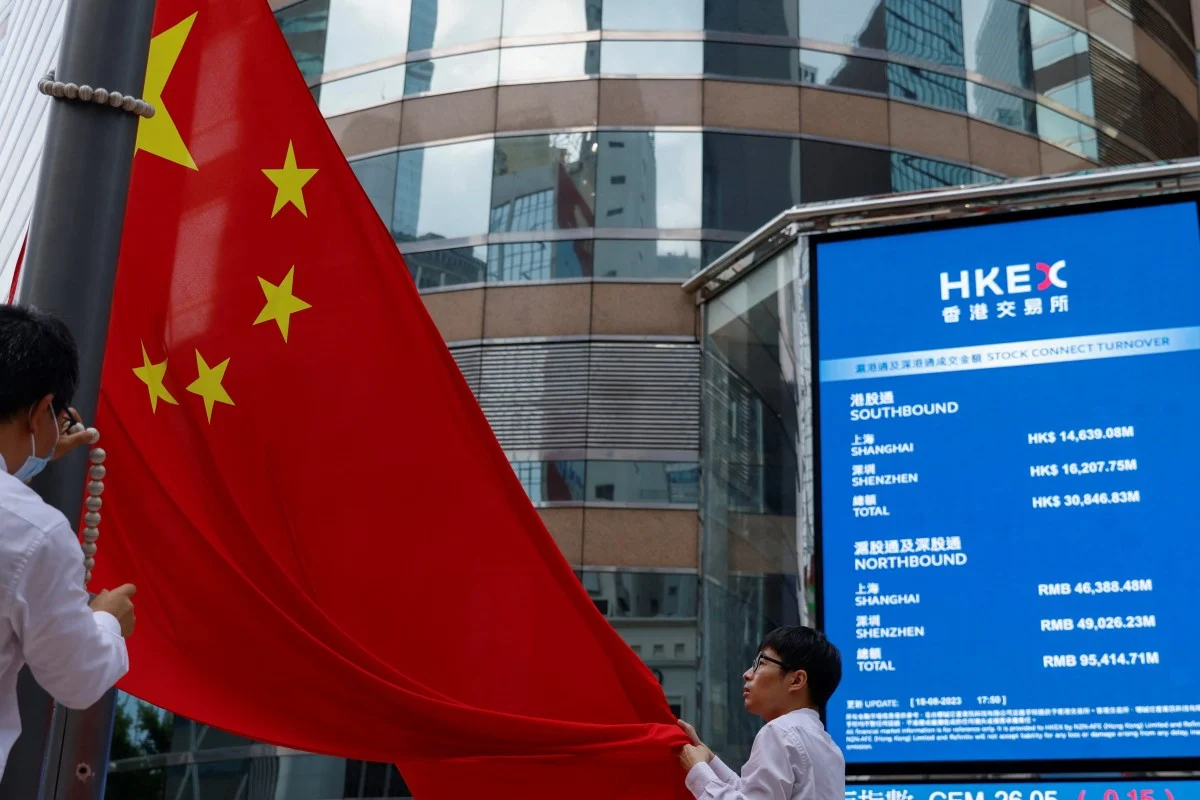

Similarly, Hong Kong’s Hang Seng index recorded its fourth consecutive decline in 2023, ending the year 13.8% lower. Both indexes ranked at the bottom among major Asia-Pacific indexes last year.

The downturn in China’s troubled property sector has weighed heavily on investor sentiment, impacting Hong Kong as well, given the listing of many Chinese real estate stocks on the HKEX, including Evergrande Group and Country Garden.

China set a growth target of 5% for 2024, but analysts remain skeptical about the economy meeting this mark. S&P Global Ratings forecasted a GDP growth of 4.6% for 2024, slower than the 5.2% rate in 2023.

Meanwhile, Indian stocks have rallied amid optimism about the country’s growth. The Nifty 50 index has risen for eight consecutive years, registering a 20% gain in 2023.

Research from HSBC also revealed that India’s NSE has surpassed the Shanghai Stock Exchange to become the world’s second-largest in terms of monthly transaction volume.

However, it still lags behind the Shenzhen Stock Exchange, which holds the top spot.

India also dominated the global IPO market in 2023, with 220 IPOs raising $6.9 billion in proceeds, a 48% increase in deal activity from 2022, according to EY India research.

In contrast, there were only 30 IPOs in China’s A-share market in the first quarter, raising $3.4 billion, the lowest since 2020.

Leave a Reply