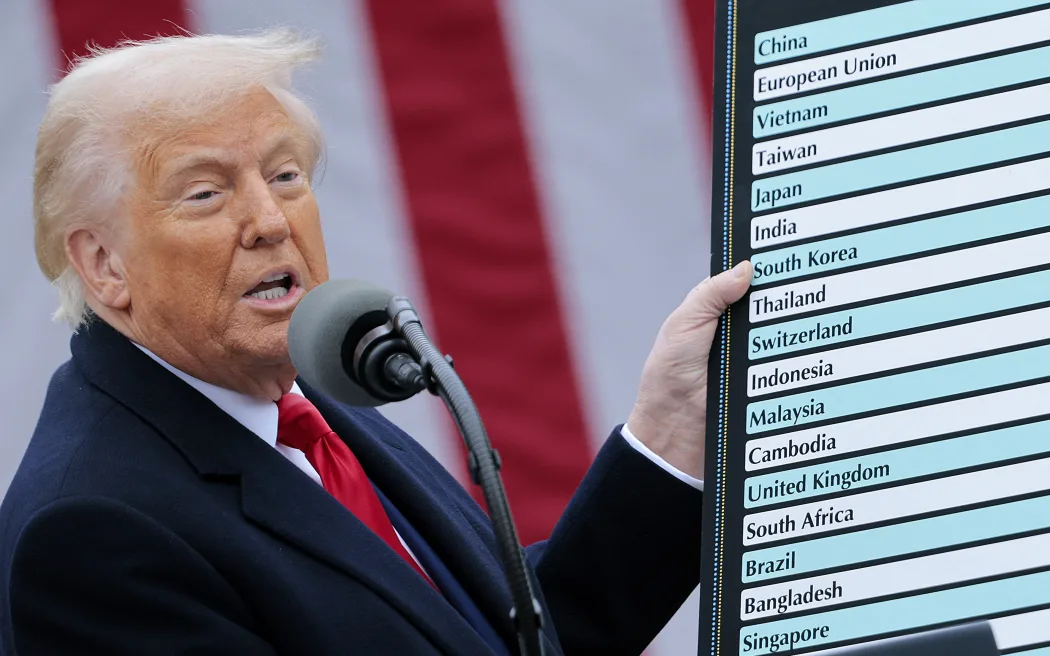

President Donald Trump’s announcement of a sweeping 46% tariff on Vietnamese imports has sent major US retailers scrambling to reassess their supply chains and pricing strategies. The tariffs, which took effect on April 9, 2025, represent one of the most significant trade policy shifts affecting American companies that have spent decades building manufacturing relationships in Southeast Asia.

Vietnam had emerged as the go-to alternative for US companies seeking to diversify away from Chinese manufacturing during previous trade tensions. The country became particularly attractive for its low labor costs, skilled workforce, and strategic location, making it a manufacturing powerhouse for everything from sneakers to furniture. In 2024, US imports from Vietnam surged to $136.6 billion, reflecting a 19% increase from the previous year, as companies continued their exodus from China-based production.

The immediate market reaction was severe and swift. Nike’s stock plummeted 14% the day after the announcement, wiping out $14 billion in shareholder value. Other major retailers with significant Vietnamese operations, including American Eagle, Wayfair, Deckers, and Hasbro, also saw their shares tumble as investors calculated the potential impact on profit margins. The tariffs come at a particularly challenging time for many retailers already grappling with inflation concerns and cautious consumer spending patterns.

For companies like Nike, which produces approximately 50% of its footwear in Vietnam, the tariffs represent an existential challenge to their cost structure and pricing strategies. The timing couldn’t be worse, as Nike is already struggling with disappointing sales forecasts and attempting to revive its brand under new CEO Elliott Hill.

Nike Bears the Brunt of Vietnam Tariff Impact

Nike faces perhaps the most severe consequences from Trump’s Vietnam tariffs, given its massive manufacturing footprint in the country. The athletic giant produces roughly half of its footwear in Vietnam, representing about 25% of its total shoe production. This translates to billions of dollars in annual revenue directly tied to Vietnamese manufacturing operations.

The financial mathematics are stark for Nike. With existing 20% duties on athletic shoes and the new 46% tariff, Nike faces a combined tariff burden that could add approximately $8.28 in costs per pair of shoes. For a standard shipping container holding 8,000 pairs, this represents an additional $66,000 in tariff costs. These numbers become even more daunting when considering Nike’s scale of operations and thin profit margins on manufacturing.

Nike’s three-decade investment in Vietnam began in 1995, making it one of the earliest foreign investors in the country’s post-reform economy. The company built a network of 130 supplier factories producing shoes, clothing, and equipment. A typical Nike sneaker, like the Air Force 1, which retails for $115, costs just $18 to produce overseas, highlighting how tariffs could dramatically impact profitability.

Retail Giants Scramble for Supply Chain Solutions

American Eagle and Wayfair represent other major casualties of the Vietnam tariff policy. American Eagle sources approximately 20% of its production from Vietnam, with CFO Michael Mathias indicating plans to reduce this reliance to single-digit percentages by late 2025. The company’s shares fell more than 5% following the tariff announcement.

Wayfair faces particularly acute challenges, as Vietnam supplies 26.5% of US furniture imports. The home goods retailer’s stock dropped 12% as investors recognized the company’s heavy dependence on Vietnamese suppliers for its product portfolio. CEO Niraj Shah had previously noted the trend of moving manufacturing away from China to countries including Vietnam, making the new tariffs especially problematic for the company’s strategy.

Industry-Wide Implications and Future Outlook

The Vietnam tariffs extend far beyond individual companies to reshape entire industry supply chains. Nearly one-third of all footwear imported into the US originated from Vietnam in 2023, according to the Footwear Distributors and Retailers of America. This makes the tariffs a sector-wide challenge rather than a company-specific problem.

Toy manufacturers, including Hasbro, Mattel, and Funk,o also face significant disruption, as many have established production relationships with Vietnamese manufacturers like GFT Group, which operates five facilities employing over 15,000 workers. Companies are now exploring cost-saving measures, including renegotiating factory costs and shifting production to alternative countries.

The broader economic implications remain uncertain, with Vietnam’s government requesting a delay of one to three months for negotiations. Trump indicated that Vietnam expressed interest in cutting tariffs to zero if a broader agreement could be reached, suggesting potential diplomatic solutions. However, until such agreements materialize, US retailers must navigate the new reality of significantly higher costs for Vietnamese-manufactured goods.