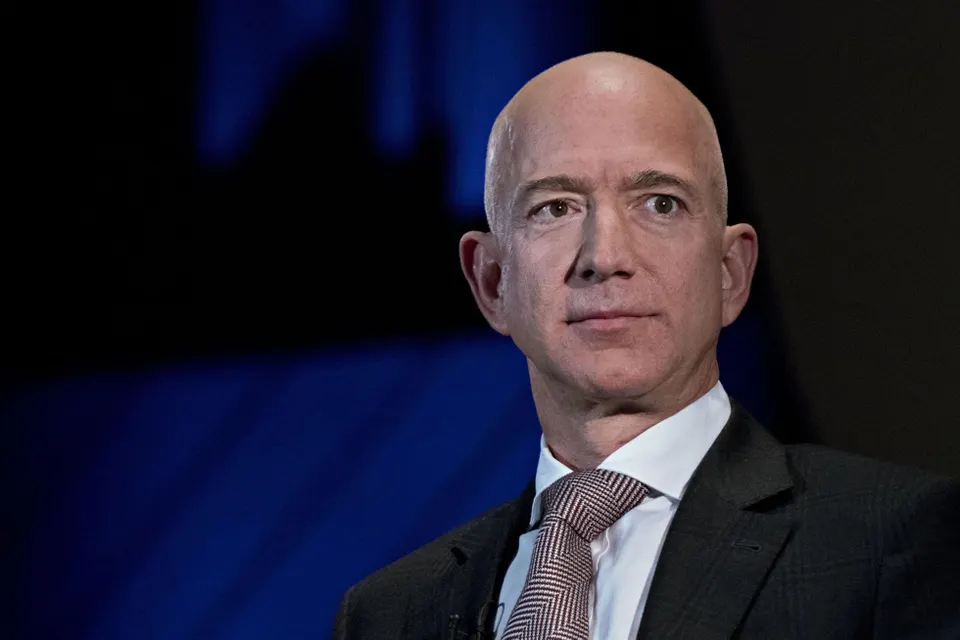

Amazon founder and executive chairman Jeff Bezos has announced plans to sell up to 25 million shares of Amazon stock worth approximately $4.8 billion over a period ending May 29, 2026. This significant divestment comes as part of a pre-arranged trading plan established in March 2025, following his record-breaking $13.5 billion stock sale in 2024.

The announcement follows Amazon’s strong first-quarter earnings report, where the company exceeded profit and revenue expectations despite concerns about slower-than-expected growth in its cloud services division, Amazon Web Services (AWS). Despite stepping down as CEO in 2021, Bezos remains Amazon’s largest shareholder and continues to play a pivotal role as executive chairman.

This latest stock sale represents a continuation of Bezos’s strategic financial planning, as he has been systematically diversifying his wealth portfolio while maintaining significant ownership in the e-commerce giant. The timing of this announcement, coming shortly after Amazon’s quarterly earnings release, demonstrates careful coordination with market conditions and regulatory requirements.

Bezos’s decision to sell shares through a structured 10b5-1 trading plan provides transparency and regulatory compliance while allowing him to fund his various ventures, including his space exploration company Blue Origin and climate change initiatives. The sale will reduce his Amazon holdings from approximately 910 million shares to around 885 million shares, maintaining his position as the company’s top individual shareholder.

Recent Stock Sales and Market Activity

Bezos has already begun executing his divestment strategy, with recent regulatory filings showing he sold 3.3 million Amazon shares worth approximately $737 million in June 2025. This transaction was completed under the same 10b5-1 trading plan established in March, demonstrating the systematic approach to his stock sales.

The June sale leaves Bezos with approximately 905 million Amazon shares, maintaining his status as the fourth-richest person globally with a net worth of $234.4 billion according to Forbes. These sales coincided with his high-profile wedding to journalist Lauren Sanchez in Venice, marking a significant personal milestone alongside his financial restructuring.

Strategic Implications and Future Plans

The $4.8 billion divestment plan represents more than just portfolio diversification for Bezos. The proceeds from these stock sales have historically funded his ambitious projects, including Blue Origin’s space exploration missions and the Day One Fund, which focuses on education in low-income communities and homelessness initiatives.

This systematic approach to stock sales allows Bezos to maintain significant influence over Amazon’s strategic direction while providing capital for his expanding business interests. The structured nature of the sales, spread over more than a year, minimizes market impact while ensuring regulatory compliance.

Amazon’s continued strong performance, particularly in cloud services and advertising revenue, supports the value of Bezos’s remaining holdings while providing him with substantial liquidity for future investments. The company’s North American sales reached $92.9 billion with an 8% increase, while AWS generated $29.3 billion in revenue, demonstrating the robust foundation supporting its stock value.