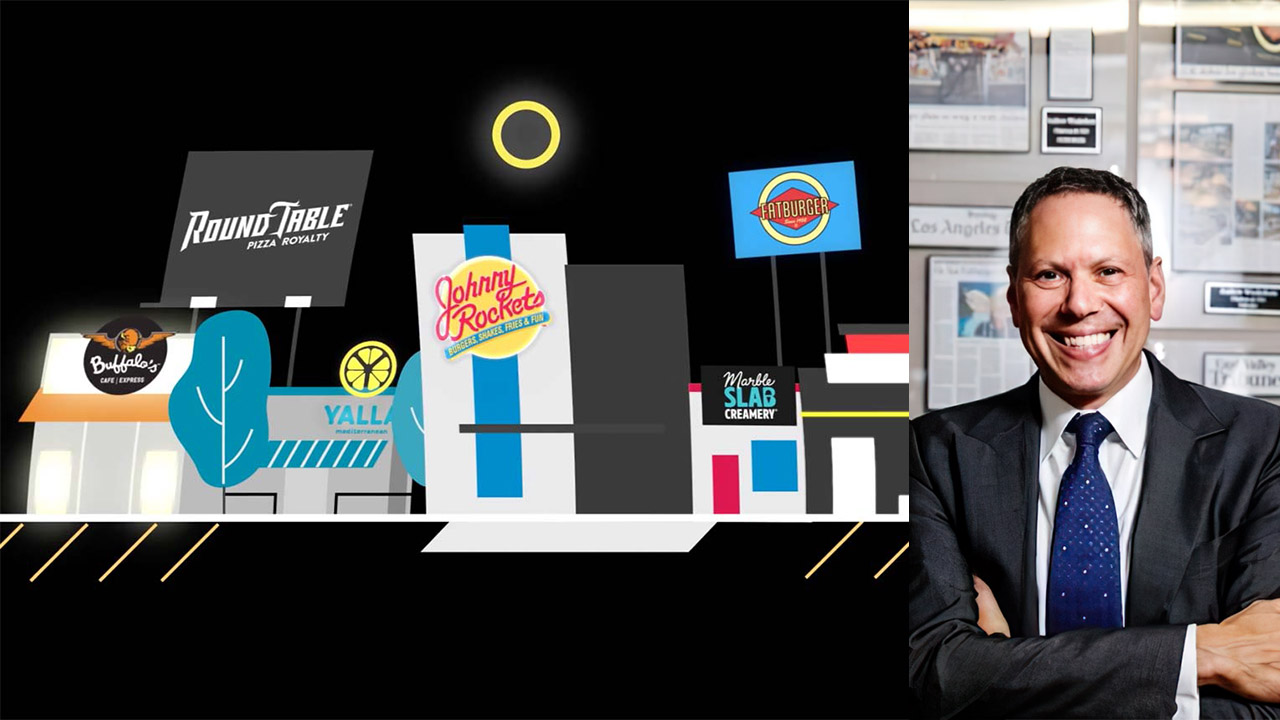

Federal authorities have charged Fat Brands and its chairman, Andy Wiederhorn, alleging a brazen scheme that purportedly secured Wiederhorn $47 million in fraudulent loans from the restaurant conglomerate that owns Fatburger, Johnny Rockets, and Twin Peaks.

Shares of Fat Brands plummeted by 24% in Friday afternoon trading, with the company’s market value now standing at $96.7 million.

Wiederhorn, along with several others, faces criminal charges from a federal grand jury in Los Angeles for wire fraud, tax evasion, and other offenses linked to the alleged scheme.

Simultaneously, the U.S. Securities and Exchange Commission (SEC) has filed a civil complaint accusing the company and Wiederhorn of infractions related to the same misconduct.

Fat Brands’ counsel, Brian Hennigan, denounced the charges as unjust, emphasizing the company’s cooperation with the investigation and asserting that the implicated conduct occurred over three years ago.

Apart from these charges, Wiederhorn faces separate criminal accusations in Los Angeles for being a felon in possession of a handgun and ammunition, stemming from a past conviction related to similar conduct.

Wiederhorn, in his capacity as CEO of Fat Brands, purportedly orchestrated the company to loan him funds, allegedly with no intention of repayment, according to the indictment.

The SEC claims Wiederhorn misappropriated these funds for personal luxuries such as private jets, luxury vacations, and expensive jewelry.

Following the disclosure of the SEC’s investigation last year, Wiederhorn stepped down as CEO. Fat Brands subsequently received a Wells notice from the SEC in February, indicating impending regulatory action.

The alleged fraud orchestrated by Wiederhorn accounted for a significant portion of Fat Brands’ revenue from 2017 to 2021, leading to financial strain as the company struggled to meet its obligations.

In some instances, Wiederhorn allegedly redirected funds from company credit cards back to Fat Brands, assisted by his son Thayer, who was formerly the company’s chief marketing officer and is now its chief operating officer.

The SEC complaint further implicates Ron Roe, the company’s vice president of finance and former CFO, and Rebecca Hershinger, another former CFO, as defendants. Hershinger’s attorney, Michael Proctor, refuted the charges, labeling them baseless.

Furthermore, the indictment reveals that Wiederhorn has been delinquent in paying personal income taxes to the IRS since 2006 and failed to report the loans from Fat Brands as income. As of March 2021, Wiederhorn owed the IRS $7.74 million in unpaid taxes.

Two decades ago, Wiederhorn pleaded guilty to tax-related offenses while leading Fog Cutter Capital and served a prison sentence. During his incarceration, Fog Cutter Capital continued to pay him a salary and a bonus equivalent to his fine, drawing widespread criticism.

Wiederhorn is expected to be arraigned in U.S. District Court in downtown Los Angeles, with arraignments for the remaining defendants scheduled for the first week of June.

Leave a Reply