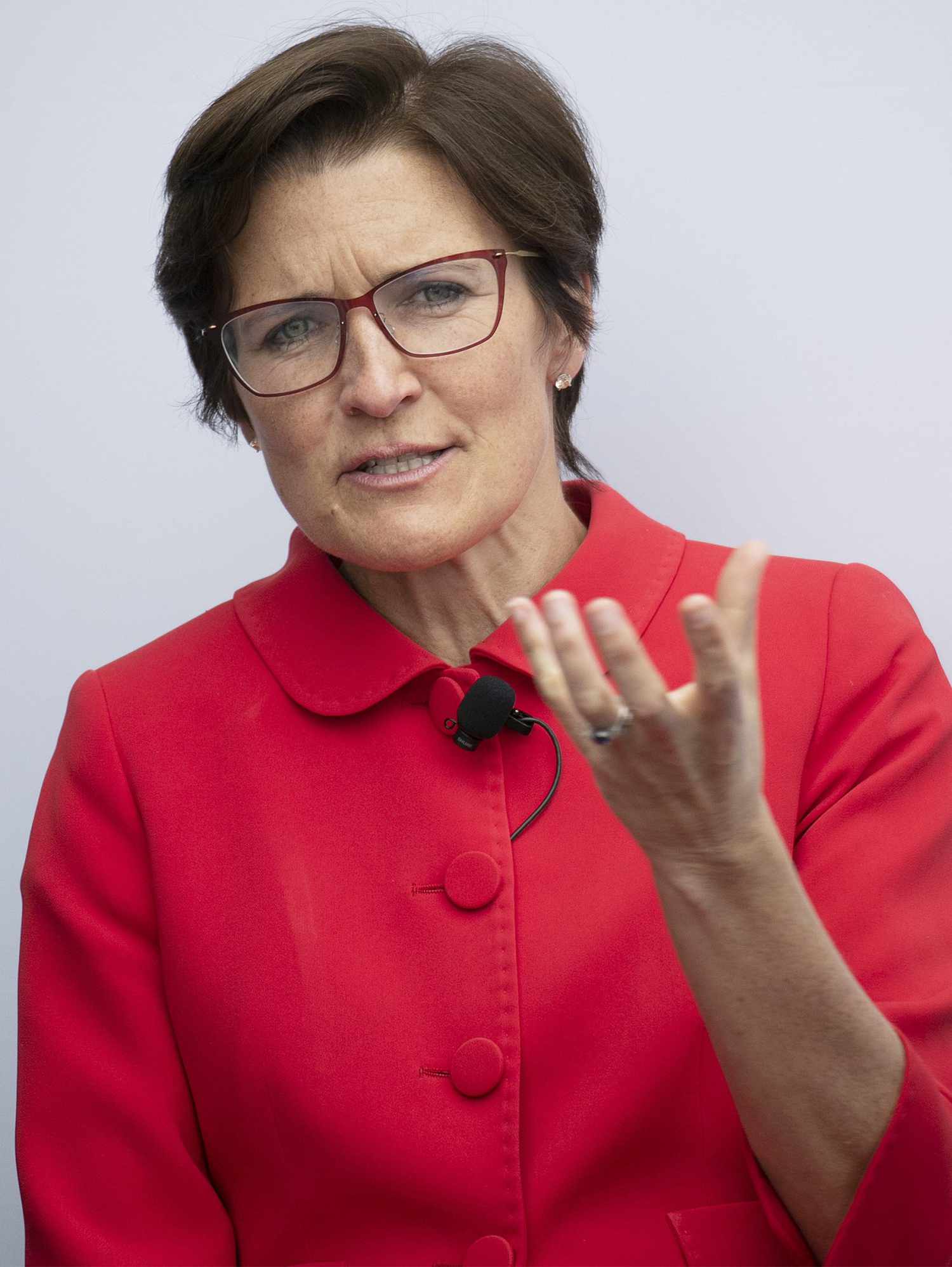

On Monday, Citigroup CEO Jane Fraser remarked on the divergence in consumer behavior amid rising inflation for goods and services, acknowledging the challenges faced by many Americans.

Fraser, at the helm of one of the largest U.S. credit card issuers, highlighted the emergence of what she termed as a “K-shaped consumer.”

This denotes a scenario where affluent individuals sustain spending habits while lower-income segments exhibit increased caution in their consumption patterns.

“In the last few quarters, a significant portion of spending growth has been attributed to affluent customers,” Fraser disclosed in an interview.

She elaborated,

“We’re witnessing a more restrained approach among low-income consumers. They’re grappling with the burden of high and escalating living costs.

While employment opportunities exist, debt obligations have surged beyond previous levels.”

The trajectory of the stock market this year has largely hinged on one pivotal question: When will the Federal Reserve initiate interest rate adjustments following a series of 11 hikes?

Robust employment statistics coupled with persistent inflation in certain sectors have complicated this narrative, prolonging the anticipation for any easing measures.

Fraser expressed optimism regarding the prospect of improved economic conditions facilitating a sooner-than-expected reduction in rates, aligning with widespread hopes among industry stakeholders.

“It’s a challenging task to achieve a soft landing,” the CEO remarked, employing a term denoting a scenario where higher rates effectively curb inflation without precipitating an economic downturn. “We remain optimistic, but it’s an inherently complex endeavor to achieve one.”

Leave a Reply