K-pop stocks have experienced a downturn this year, with JYP Entertainment leading the losses in the sector by shedding a third of its market value. Goldman Sachs attributes this decline to investors’ focus on album sales, which have decreased in the latter half of 2023.

However, despite the challenges, Goldman Sachs expressed optimism for the industry in a recent report, stating that the K-pop sector is “misunderstood.”

While shares of major K-pop companies have declined since the beginning of the year, Goldman Sachs sees a high potential for valuation re-rating, as these companies continue to deliver multi-year earnings growth.

Investment Bank Sees Potential Turnaround Amid Market Misunderstanding

Goldman challenges the mainstream mindset that evaluates K-pop companies based on album sales, arguing that in-person concert attendance is a superior metric for measuring the industry’s reach.

They suggest that album sales can be skewed by wallet share, where one fan purchases multiple albums, and note that the pandemic artificially inflated album sales due to the lack of offline interactions.

In evaluating the industry by concert attendance, Goldman sees continued rapid growth, particularly in Japan. They believe that Japan, which has been one of the largest overseas fan bases for K-pop, presents a significant growth opportunity that the market has overlooked.

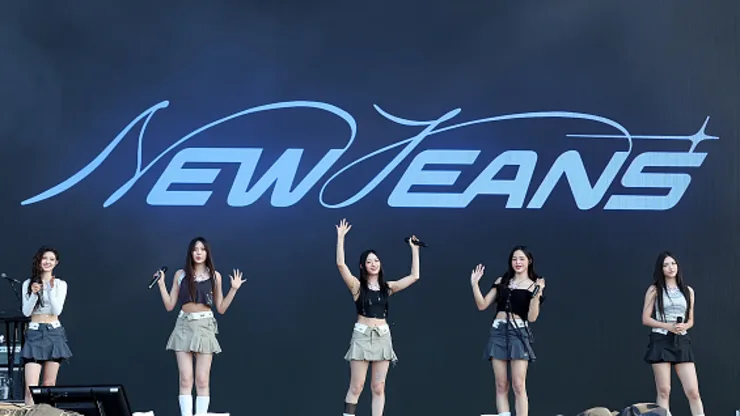

Goldman also highlights the global expansion of K-pop’s fan base, especially in markets like the United States. They point to the success of Hybe-managed girl group NewJeans on the U.S. charts and their performance at music festivals like Lollapalooza and Coachella.

Moreover, Goldman notes Hybe’s expanded partnership with Universal Music Group as a sign of K-pop’s increasing mainstream presence globally.

This partnership enhances K-pop’s bargaining power in business relationships, indicating a strong competitive position for the industry.

Leave a Reply