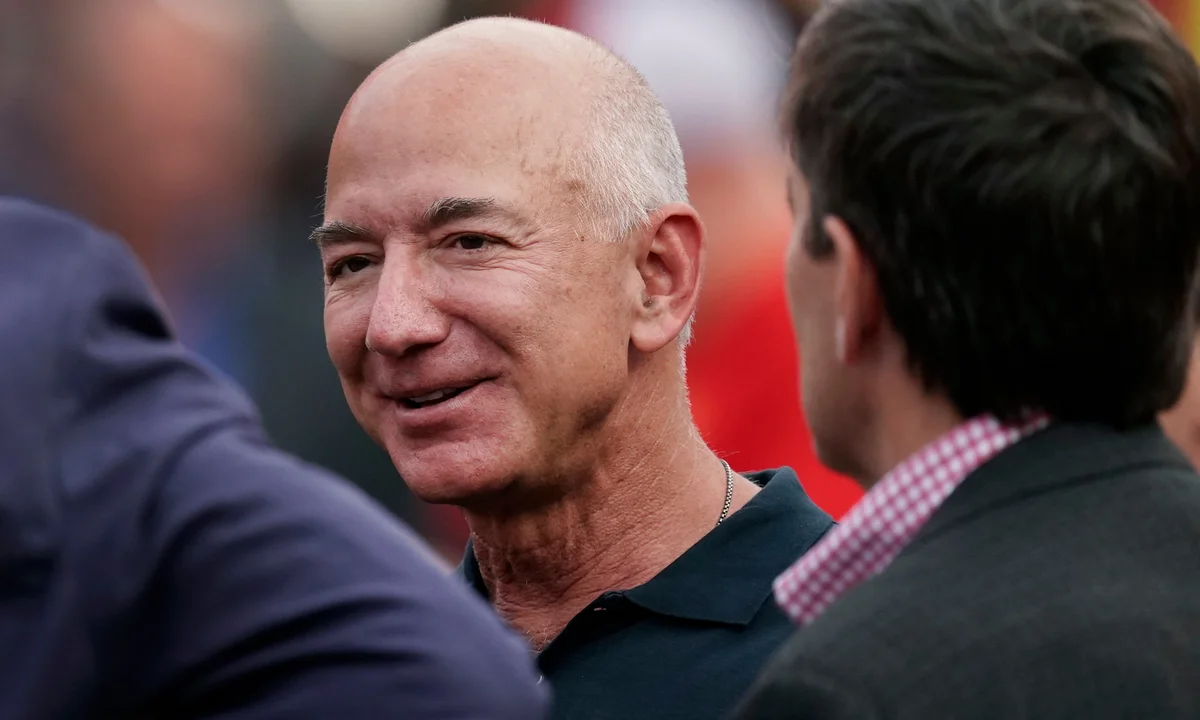

Jeff Bezos’ $2 billion stock sale last week brought with it an additional benefit: avoiding state taxes.

Last year, Bezos announced on Instagram his decision to leave Seattle, where he had lived for nearly 30 years, and relocate to Miami.

He cited reasons such as being closer to his parents and his rocket ventures with Blue Origin. However, the timing also hinted at another factor: taxes.

In 2022, Washington state introduced a new 7% capital gains tax on the sale of stocks or bonds exceeding $250,000. While Washington does not have a personal income tax, this new tax was the first time Bezos would incur state taxes on his stock sales.

Since 1998, Bezos had regularly sold billions of dollars worth of Amazon shares each year to support his philanthropy, his space company Blue Origin, and more recently, his $500 million mega yacht and expanding collection of mansions purchased with his fiancée, Lauren Sanchez.

When the new tax took effect in 2022, Bezos ceased selling shares. He did not sell any Amazon stock in 2022 or 2023, limiting his transactions to a $200 million donation of shares at the end of last year.

Following his move to Miami, Bezos resumed his stock sales. Last week, an SEC filing revealed that Bezos initiated a pre-scheduled plan to sell 50 million shares before January 31, 2025. At current prices, this would amount to over $8.7 billion.

Florida, unlike Washington, does not impose state income or capital gains taxes. As a result, Bezos saved $140 million on the $2 billion sale last week that he would have owed to Washington state.

On the entire planned sale of 50 million shares over the next year, he stands to save at least $610 million. This estimate assumes Amazon’s share price remains stable; if the price increases, both the value of his shares and his tax savings could be even higher.

In other words, the tax savings from his Florida move have more than covered the cost of his 417-foot yacht, Koru.

For his new residence, Bezos acquired two mansions in Indian Creek for $147 million and is reportedly considering three additional properties on the island, which is also home to Tom Brady and Carl Icahn.

Miami real estate experts suggest Bezos may demolish the existing homes to construct a new estate, with total costs for the new property potentially exceeding $200 million.

Leave a Reply