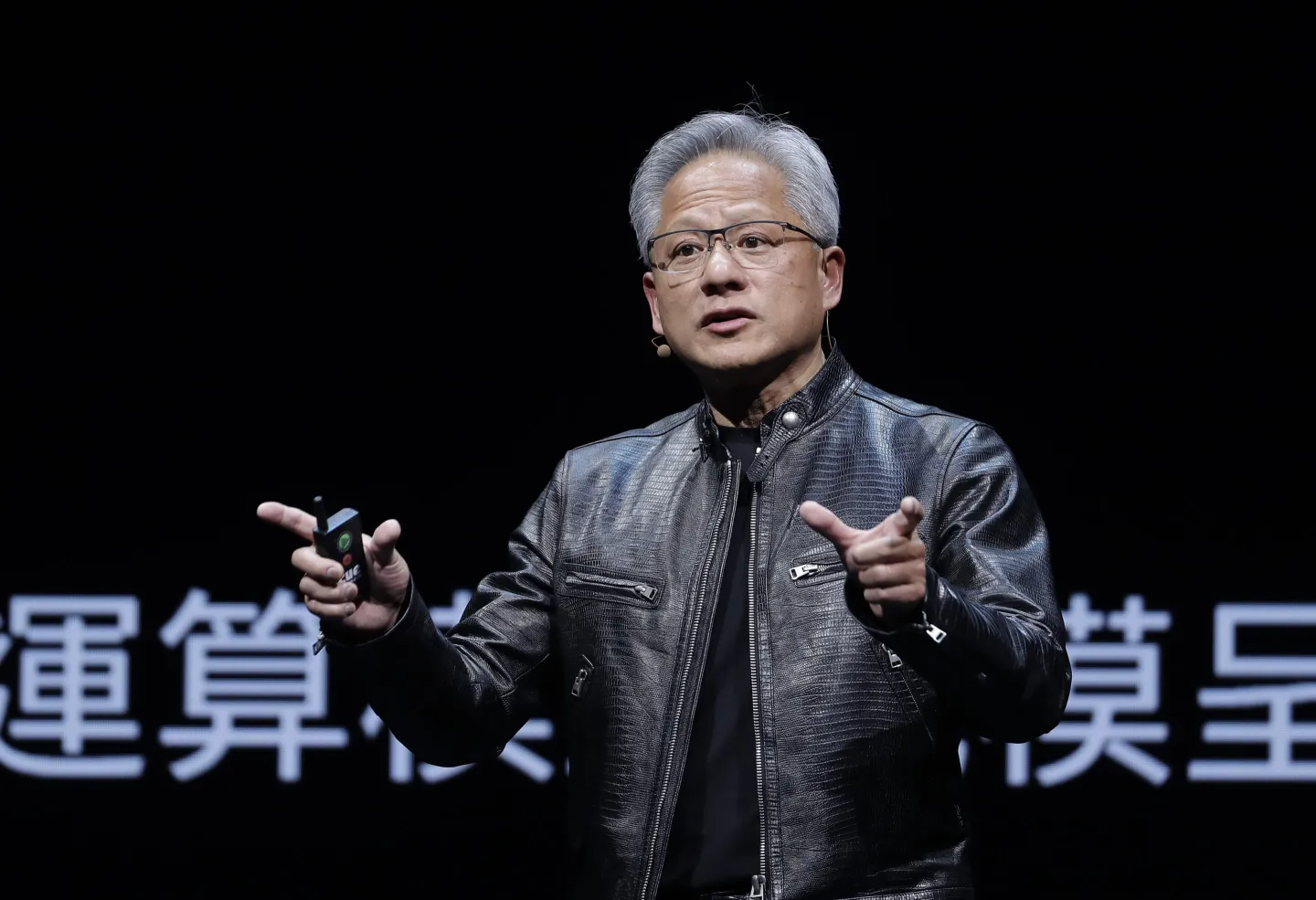

Shares of AI chip designer Nvidia continued to decline overnight following reports that U.S. authorities are intensifying their investigation into whether the company violated competition laws.

Nvidia’s shares dropped by 2.4% in after-hours trading, compounding a nearly 10% decline during the regular trading session.

This significant drop erased $279 billion (£212 billion) from the company’s market value, reducing it to $2.6 trillion—marking the largest single-day loss in history for a U.S. company.

The U.S. Department of Justice issued subpoenas to Nvidia and other tech firms, compelling them to provide information under legal mandate.

Officials are reportedly concerned that Nvidia has made it difficult for clients to switch to other semiconductor suppliers and has penalized buyers who refuse to exclusively use Nvidia’s AI chips.

If confirmed, such actions would indicate an escalation of the U.S. antitrust investigation, potentially leading to a formal complaint against Nvidia.

The sell-off on Tuesday occurred alongside a broader market downturn triggered by weak U.S. manufacturing data, which heightened investor concerns about the country’s economic outlook.

The Institute for Supply Management’s monthly factory survey revealed that manufacturing contracted at a moderate pace in August, with declines in new orders, production output, and employment levels.

This led to a more than 2% drop in the S&P 500 index, while the tech-heavy Nasdaq Composite fell nearly 3.3%.

The fear spread to Asian markets, where Japan’s Nikkei 225 index plunged 4.2% on Wednesday, and Australia’s S&P/ASX 200 index decreased by 1.9%.

These developments have exacerbated recent volatility in Nvidia and other AI-related stocks, including Google, Apple, and Amazon, as investors worry about the delayed realization of practical impacts and substantial returns from the highly anticipated AI revolution.

Founded in 1993, Nvidia initially focused on designing chips for video games. The company later capitalized on the cryptocurrency boom by leveraging its processing technologies for mining digital currencies.

More recently, Nvidia has shifted its focus to artificial intelligence, riding a wave of enthusiasm over the potential of large language models.

Despite reporting a 122% increase in second-quarter revenues last week, Nvidia spooked investors with signs of a potential slowdown in growth, particularly regarding its next-generation AI chips, codenamed Blackwell.

In response, a Nvidia spokesperson stated, “Nvidia wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them.”

Leave a Reply