Concerns over the burgeoning US government debt are being echoed by various influential figures.

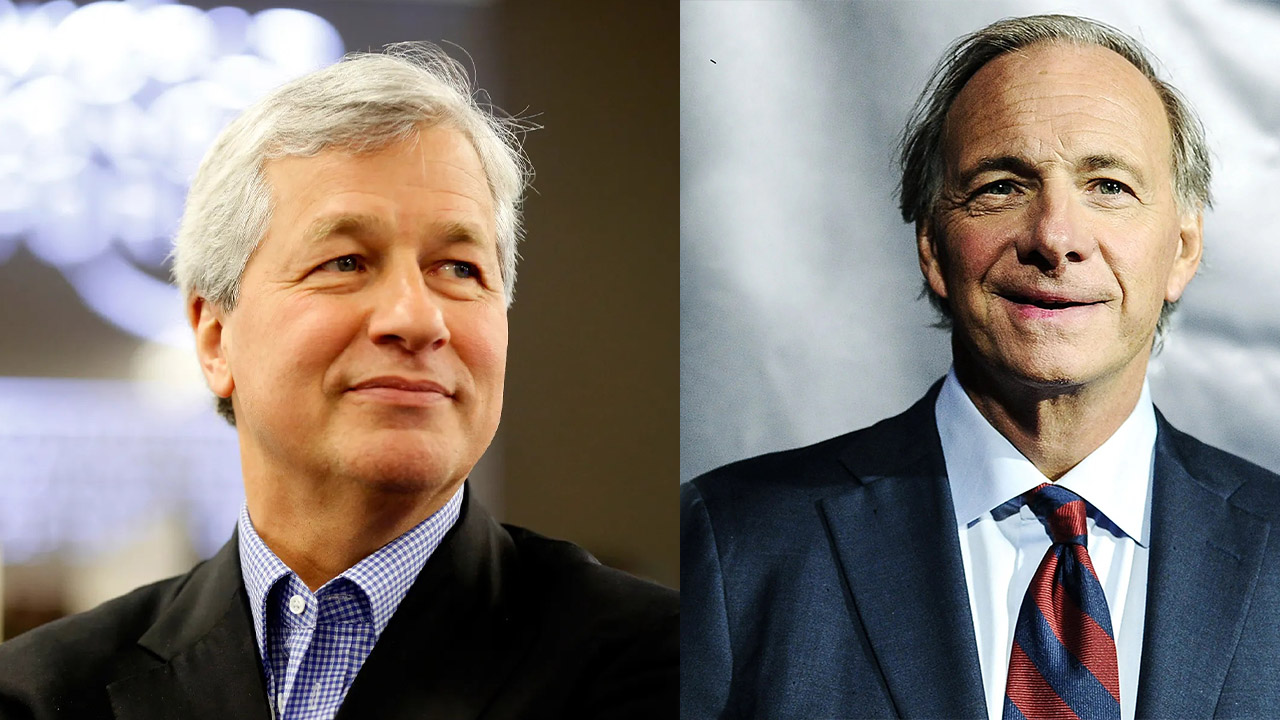

In the last 24 hours, both JPMorgan CEO Jamie Dimon and Ray Dalio, the founder of the world’s largest hedge fund, have voiced apprehensions about the size of America’s debt.

In an interview with Sky News on Wednesday, Dimon expressed hope that the US government would prioritize reducing its budget deficit — the disparity between its spending and tax revenues each year — before financial markets compel action.

Dimon emphasized, “The sooner we focus on it, the better. At one point, it will cause a problem… the problem will be caused by the market, and then you’ll be forced to deal with it and probably in a far more uncomfortable way than if you dealt with it to start.”

The widening deficits contribute to the total US government debt as they necessitate the Treasury to issue more bonds to cover the shortfall.

Similarly, Dalio expressed concerns about the diminishing investor demand for these government bonds, known as Treasuries. He told the Financial Times, “I’m… concerned about the softening demand to meet supply, particularly from international buyers worried about the US debt picture and possible sanctions (against countries other than Russia).”

If investor confidence wanes, they might demand higher returns, or yields, on Treasuries — a risk already highlighted by the International Monetary Fund (IMF) and the Congressional Budget Office (CBO) — potentially leading to increased borrowing costs across the US economy.

Dimon and Dalio’s remarks reflect widespread anxieties regarding the broader implications of the substantial US government debt burden, which the Treasury Department estimates at $34.6 trillion, surpassing the size of the US economy.

Dimon acknowledged that government spending fueled by debt, including pandemic-related stimulus measures, has been a factor contributing to robust economic growth in the US. He noted, “America spent a lot of money during Covid and after Covid. Our deficit (is at) 6% now, that’s a lot, but obviously that drives growth.”

However, this spending spree has also contributed to rising consumer price inflation. Dimon cautioned, “Any country can borrow money and drive some growth but it may not always lead to good growth, so I think America should be quite aware that we’ve got to focus on our fiscal deficit issues a little bit more and that is important for the world.”

Last month, the IMF warned that the high and increasing level of US government debt posed a risk of elevating borrowing costs globally and undermining global financial stability.

This caution echoed a stark message from the head of the CBO, the US Congress’s independent fiscal watchdog, who warned of a potential bond market crisis similar to that experienced by the United Kingdom under former Prime Minister Liz Truss.

There is already evidence suggesting that investors are demanding higher returns to hold US Treasuries, partly due to concerns about the trajectory of debt.

In fiscal year 2023, the US government spent more on debt servicing than on essential services such as housing, transport, and higher education, according to the Committee for a Responsible Federal Budget.

The United States is not alone in grappling with increasing indebtedness. The European Central Bank anticipates that government debt in the eurozone will remain high post-pandemic, rendering European governments more susceptible to adverse shocks such as heightened geopolitical tensions.

Leave a Reply