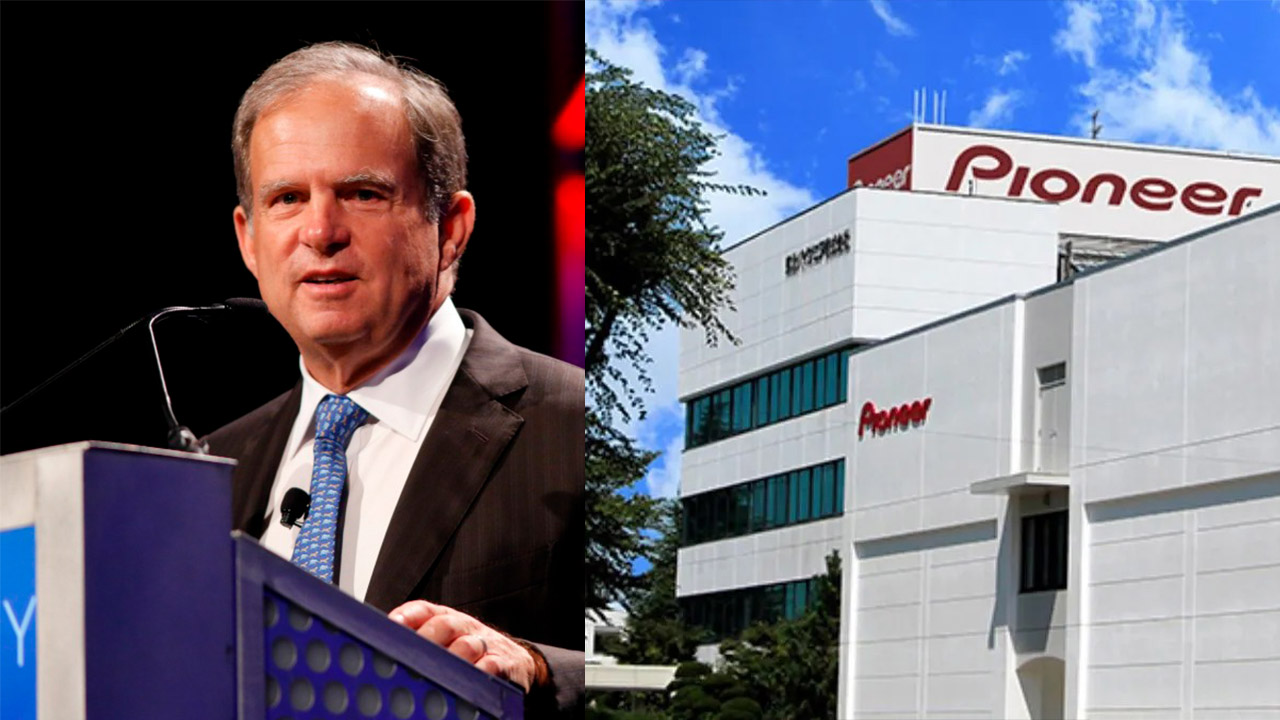

The Wall Street Journal has reported allegations of collusion against Scott Sheffield, the former chief executive of Pioneer Natural Resources, by the Federal Trade Commission (FTC).

According to unnamed sources cited by the WSJ, Sheffield is accused of attempting to coordinate production cuts among shale oil producers and companies from OPEC to boost oil prices, thus benefiting Pioneer.

The report indicates that Sheffield communicated extensively with representatives of the Organization of the Petroleum Exporting Countries (OPEC) regarding market dynamics, including pricing and production levels. These allegations are expected to be formalized by the end of the week.

As a result of these allegations, Sheffield has been prohibited from joining the board of Exxon after its acquisition of Pioneer, as mandated by the FTC as a condition for approving the $60 billion deal.

Exxon’s plan to acquire Pioneer Natural Resources was first announced last October, with Exxon offering an all-stock deal valued at approximately $58 billion.

The acquisition aims to significantly expand Exxon’s Permian footprint, creating a substantial undeveloped U.S. unconventional inventory position.

The FTC has been closely monitoring this deal, along with others in the oil sector, as industry consolidation continues.

Concerns raised by nearly 50 Democratic Senators and Representatives prompted the agency to investigate recent mergers in the oil and gas sector amid fears of potential competition issues and consumer harm.

However, some legal experts have dismissed these concerns, arguing that the oil industry has previously successfully contended that local mergers, even between major players like Exxon and Pioneer or Chevron and Hess Corp., do not pose antitrust concerns due to the global nature and scale of the oil market.

Leave a Reply