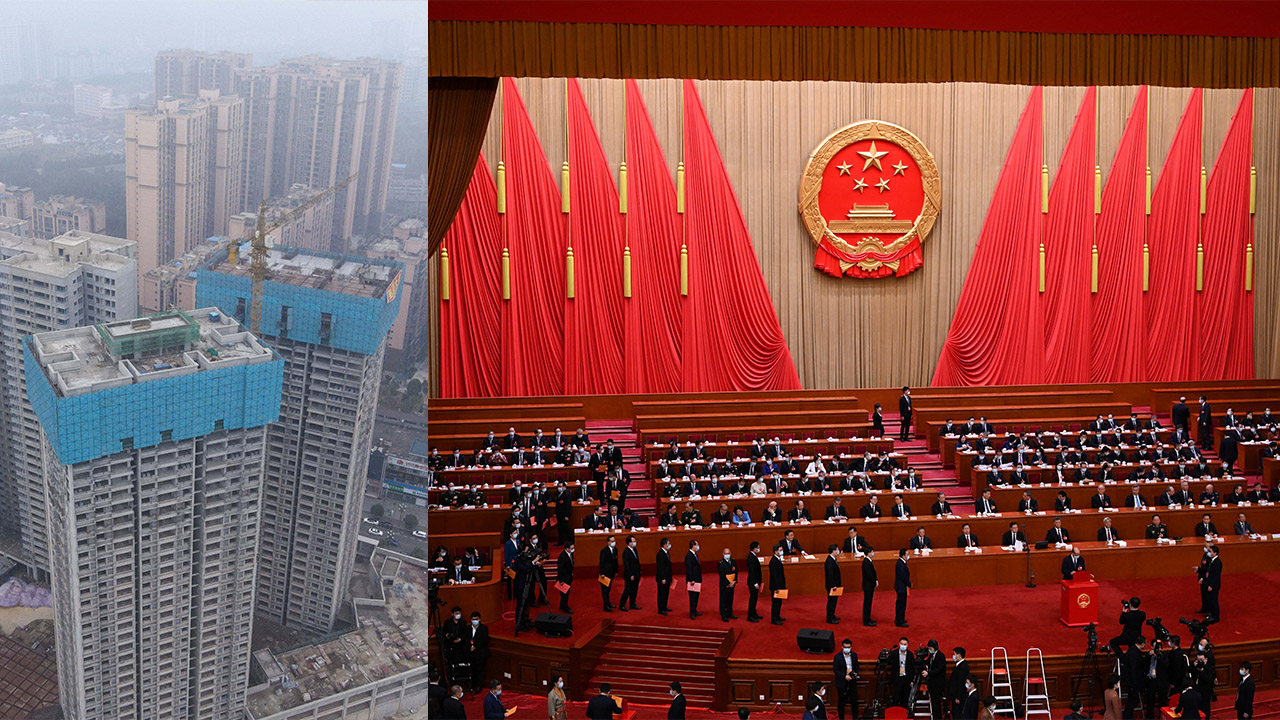

China is considering a plan for local governments nationwide to purchase millions of unsold homes, reported on Wednesday, following a meeting of the ruling Communist Party’s leaders that called for efforts to address the increasing housing inventory.

The State Council is currently gathering feedback on this preliminary plan from various provinces and government bodies, the report added, citing sources familiar with the matter.

In response to the news, China’s blue-chip CSI 300 real estate index (.CSI000952) rose as much as 6% at one point before trimming gains, while the yuan strengthened.

China’s property sector has been in a prolonged slump, exacerbated by a debt crisis among developers. Since 2022, multiple policy measures have failed to revive a sector that accounts for about a fifth of the economy and remains a significant drag on consumer spending and confidence.

Banks have been hesitant to respond to Beijing’s repeated calls to increase credit to the struggling sector due to the risks of more bad loans and persistent weak sales. According to recent surveys by CRIC, a major real estate information provider, the home sales value of the top 100 developers in April dropped 45% from a year earlier.

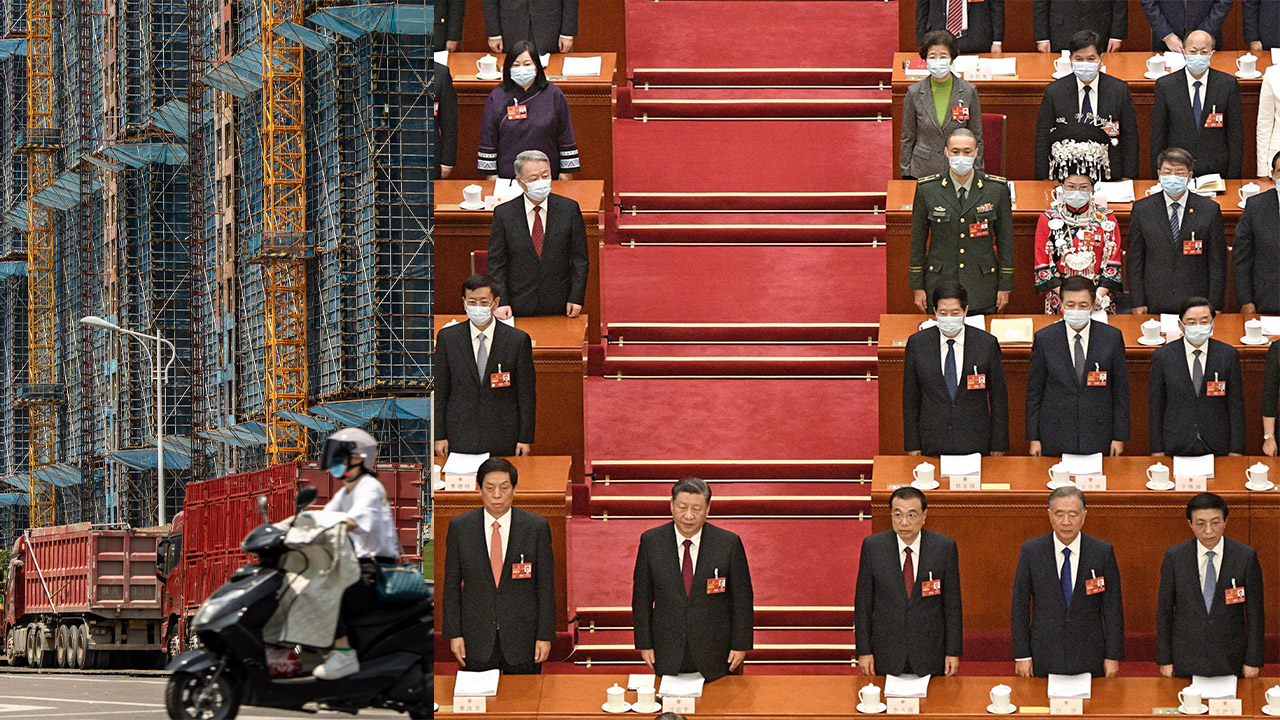

The Politburo of the Communist Party held a meeting on April 30, stating it would enhance policies to clear the growing housing inventories. Dozens of cities have offered subsidies to encourage residents to replace old apartments with new ones, aiming to sell the increasing stock of new apartments and provide crucial cash flow to struggling developers.

According to the report, local state-owned enterprises would be asked to purchase unsold homes from distressed developers at significant discounts using loans provided by state banks. Many of these homes would then be converted into affordable housing.

Officials in China are debating the plan’s details and feasibility, and it could take months to finalize if the country’s leaders decide to proceed, the report said.

In a related move, the Linan district in the eastern city of Hangzhou issued a notice on Tuesday that the local government will purchase new apartments from private developers for public rental housing.

The district, which has 650,000 residents, stated that the total area of the flats purchased would not exceed 10,000 square meters. The homes will be existing houses or pre-sold homes available for delivery within one year.

One of the biggest challenges to property demand is that financially strained private developers have halted construction on many new homes that were pre-sold but now cannot be delivered on time.

Buyers of these homes are still paying off their mortgages. Estimates vary widely, but analysts agree that tens of millions of uncompleted apartments exist across China following a building boom that turned to bust.

“It’s been our view that Beijing will eventually have to address concerns about homes being delivered,” economists from Nomura said in a recent research note.

“Beijing should reach into its own pockets, even with printed money from the People’s Bank of China, to support the completion of new homes that were pre-sold by developers,” they noted, adding that such a move makes more sense than building public housing from scratch.

Nomura expects that Beijing will eventually set up a special agency and allocate a special fund for such a rescue.

Leave a Reply