In the sphere of investment, the integration of artificial intelligence (AI) is revolutionizing the scenario, offering individuals unprecedented avenues to bolster their financial portfolios.

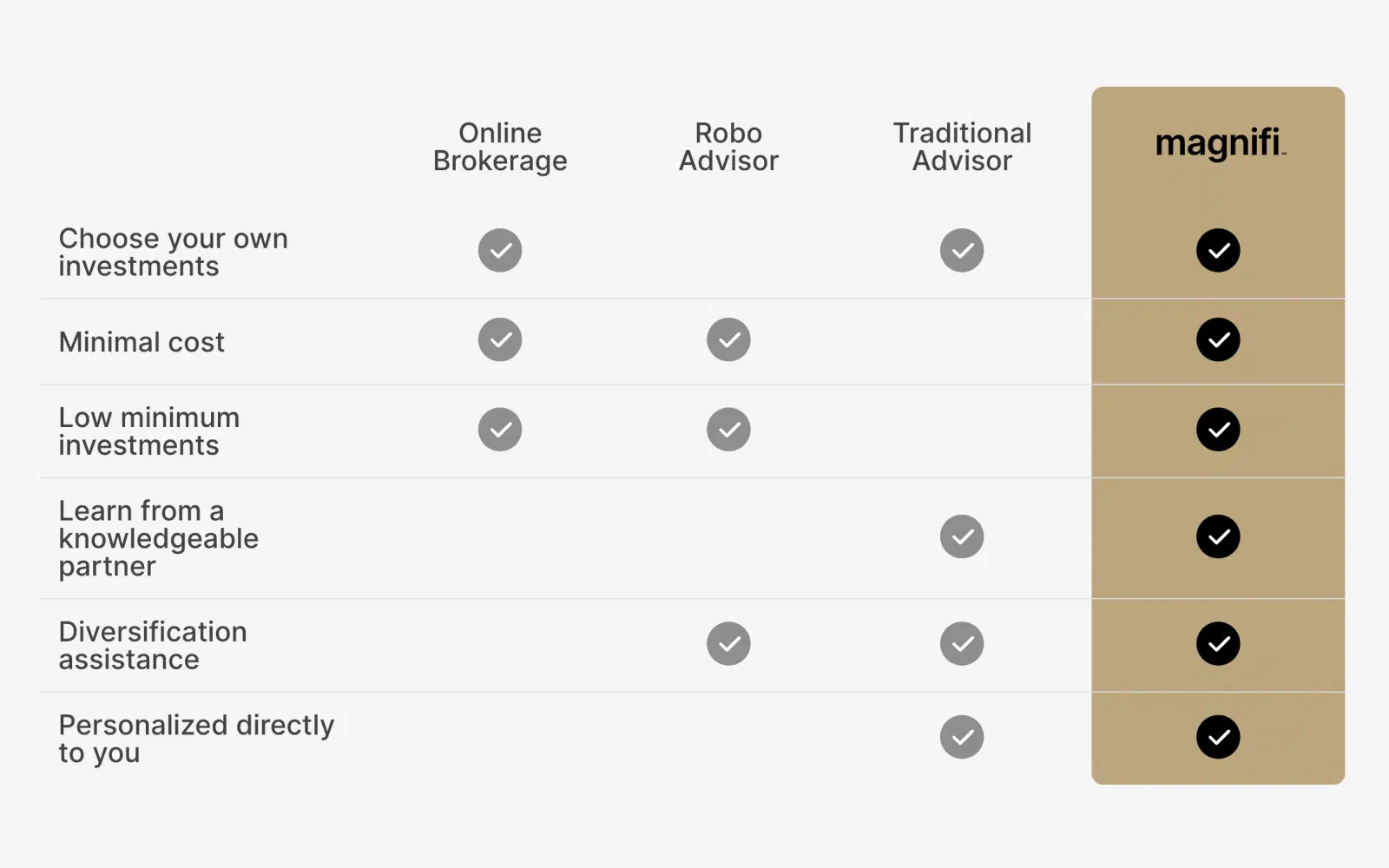

Traditionally, seeking advice from financial advisors has been the norm, but with the advent of AI-powered platforms, investors now have compelling alternatives at their fingertips.

Institutional investors, such as hedge funds and private equity firms, have long leveraged AI to refine their investment strategies.

By integrating AI into algorithmic trading and quantitative analysis, these entities pinpoint lucrative investment opportunities with remarkable precision.

Predictive learning algorithms, for instance, enable them to forecast revenue trajectories of publicly traded companies over extended periods, empowering informed decision-making.

How AI-Powered Platforms are Redefining Financial Decision-Making

Individual investors are increasingly tapping into AI-driven services to optimize their investment endeavors. Platforms like Magnifi and Wealthfront have emerged as frontrunners in this domain, offering tailored solutions to users’ investment needs.

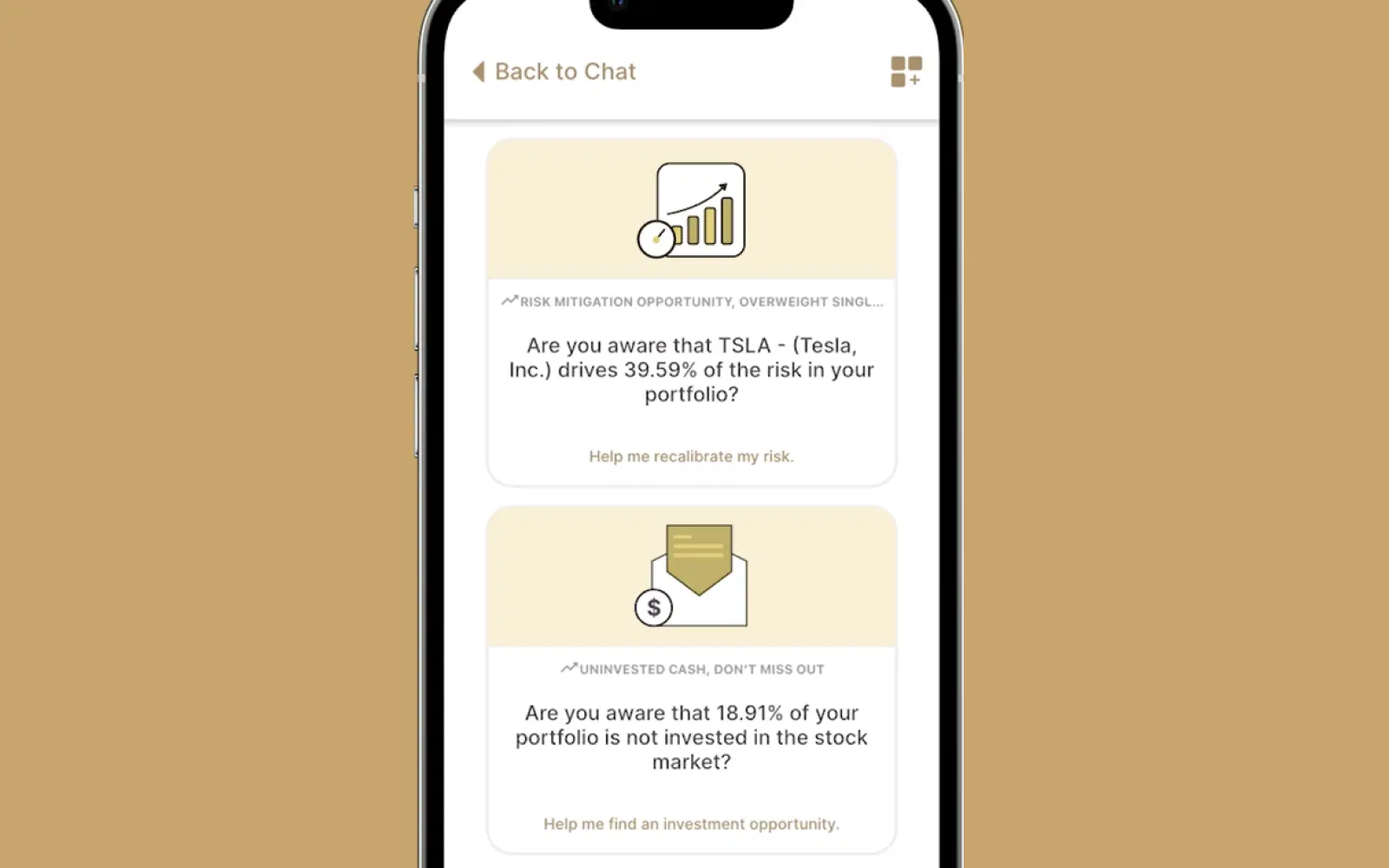

Magnifi, for instance, employs AI to evaluate clients’ expected returns on their stock portfolios vis-à-vis benchmarks like the S&P 500 Index. Its AI-powered investing assistant facilitates the construction of diversified portfolios or kick-starting retirement investments swiftly and efficiently.

Similarly, Wealthfront’s robo-advisor aids in stock selection, streamlining the investment process for users. While these services may entail fees, the value they offer in terms of optimized investment decisions often outweighs the cost.

Enter ChatGPT, a trailblazing AI service renowned for its prowess in providing comprehensive answers to investment queries.

Harnessing deep learning algorithms, ChatGPT mines information from diverse online sources to furnish users with insightful responses.

Its premium version, ChatGPT Plus, boasts even more sophisticated capabilities, delving into complex functions such as analyzing financial statements and forecasting future trends.

However, while AI-based programs offer unparalleled convenience and efficiency, they are not devoid of limitations.

Free versions may lack the depth of analysis found in subscription-based models, and AI assistants inherently lack the human touch provided by traditional financial advisors.

Leave a Reply