UK stocks are currently trading at a notable discount compared to their counterparts on Wall Street, enticing certain investors back into the UK’s beleaguered stock market.

In recent years, London-listed equities have underperformed as key sectors like banking and energy struggled to match the rapid ascent of technology stocks. Political uncertainty following the 2016 Brexit referendum further weighed on market sentiment.

Nonetheless, it enjoyed its strongest week since September amid growing investor confidence that the Bank of England will implement multiple interest rate cuts this year.

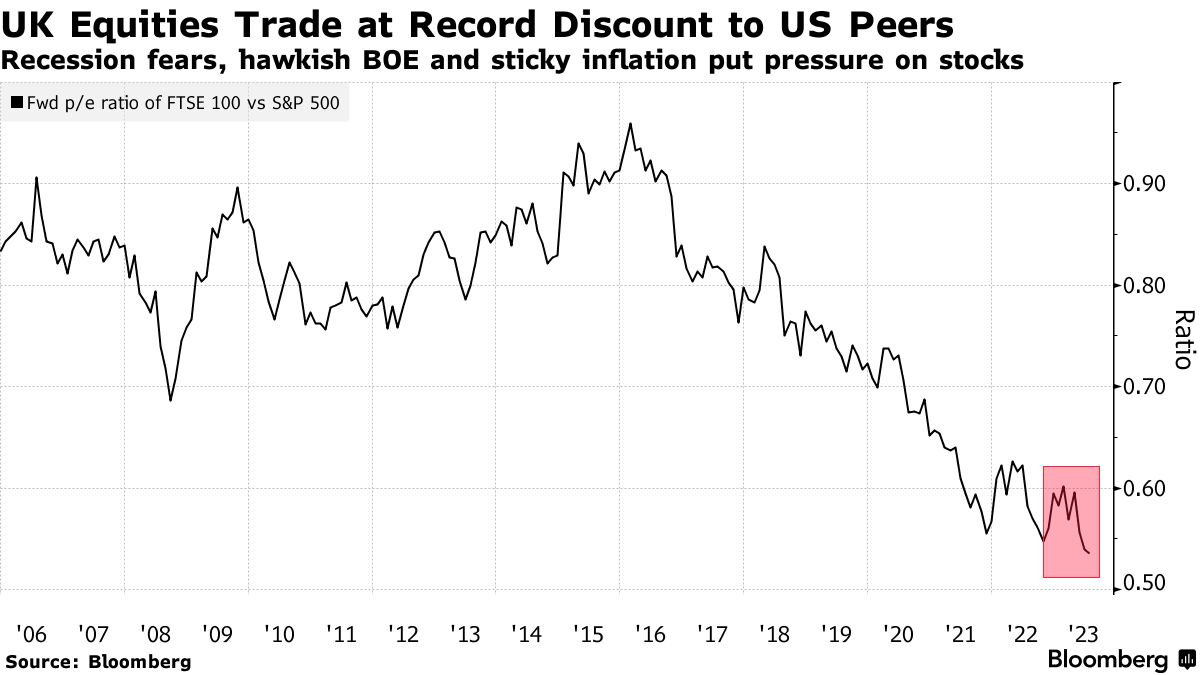

Forward price-to-earnings ratios for stocks on the MSCI UK index are 47% lower than their US counterparts, according to asset manager Schroders. This discount, which hit 48% in January, marks the largest gap since records began in 1988.

The disparity between UK and US markets reflects a lack of investor enthusiasm for the UK market, which is heavily weighted towards sectors such as banking and mining, lacking the high-growth technology stocks prevalent on Wall Street.

Despite some companies opting to list in New York due to higher valuations, UK stocks are starting to pique the interest of fund managers drawn to their value proposition.

Alex Wright, a portfolio manager at Fidelity International, highlights the compelling value within the UK market, particularly favoring value stocks in anticipation of a return to a more normal inflation and interest rate environment.

HSBC strategist Edward Stanford emphasizes the resilience of the UK economy, advocating for domestically focused mid-cap stocks like the FTSE 250, which stand to benefit from favorable macroeconomic conditions in the UK.

As one partner at a multibillion-dollar hedge fund notes, there are undeniably attractive bargains to be found amidst the broader uncertainty.

Leave a Reply