On Tuesday, Macy’s announced plans to close approximately 150 of its namesake stores while focusing on opening new locations in better areas or those offering luxury goods.

This strategic shift reflects the company’s emphasis on successful operations, like the higher-end Bloomingdale’s and the beauty chain Bluemercury, and a reevaluation of its underperforming Macy’s stores, particularly those situated in struggling malls.

According to Macy’s holiday quarter results released Tuesday, the performance of its Macy’s stores lagged behind both Bloomingdale’s and Bluemercury.

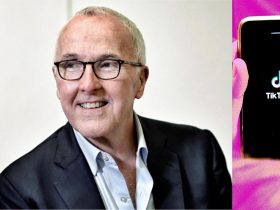

The announcement of these changes follows the recent appointment of former Bloomingdale’s CEO Tony Spring as Macy’s CEO on February 4. Macy’s had previously disclosed in January plans to close five Macy’s stores and lay off over 2,300 employees.

In a interview on Tuesday, Spring explained that the company is reexamining its store locations to address the disparity between high-performing and underperforming stores.

“We have some stores that are just underproductive or not as profitable, and we have to address that,” he said.

“Conversely, we have stores that are highly productive and highly profitable. We have markets and stores and centers we’re not in today that we’d like to be in.”

Here is a detailed overview of Macy’s major store changes, categorized by brand:

Sales at Macy’s namesake stores have been the weakest, prompting significant changes. The company plans to close about 150 stores, with 50 expected to shut down by early 2025.

Although specific locations have not been disclosed, these stores are deemed “unproductive.”

One prominent store set to close is Macy’s 400,000-square-foot flagship in San Francisco’s Union Square, pending the sale of the location.

Marisa Rodriguez, CEO of the Union Square Alliance, informed that the store might remain open for several months, including through the holiday season, as finding a buyer could be a lengthy process.

Additionally, Macy’s has confirmed the closure of stores in Arlington, Virginia; San Leandro, California; Lihue, Hawaii; Simi Valley, California; and Tallahassee, Florida, with these closures scheduled for early 2024.

Conversely, Macy’s plans to increase investment in the approximately 350 locations that will remain open. Spring mentioned that the company is experimenting with improved customer service at 50 of these stores, such as enhancing support in fitting rooms and shoe departments.

The company is also advancing its strategy to open smaller Macy’s stores in suburban strip malls. Last year, it announced plans to open up to 30 of these smaller locations over the next two years, with each store being about one-fifth the size of its traditional mall counterparts.

Spring highlighted a notable difference between the stores set for closure and those that will remain operational. The 150 stores slated for closure represent 25% of Macy’s square footage but account for less than 10% of its sales.

“They’re underproductive, and we have to focus on making sure that we have the best stores, not the largest number of stores,” he stated during an earnings call.

The evaluation process for store closures included considerations of economics, customer demographics, digital demand, and the condition of the store or shopping center.

As of February 4, Macy’s operated around 500 namesake stores, including traditional mall locations, smaller shops, and freestanding locations for its off-price banner, Backstage.

Bloomingdale’s, which has outperformed Macy’s namesake stores, will see an expansion with the addition of about 15 new locations over the next three years.

While specific locations have not been announced, some will be in new markets. Bloomingdale’s, known for catering to higher-income and fashion-forward shoppers and featuring many luxury brands, is also experimenting with a smaller store concept called Bloomie’s.

At the end of the most recent fiscal year, Bloomingdale’s had 33 locations, along with three Bloomie’s shops and 21 outlets.

Bluemercury has been the strongest performer among Macy’s brands, showing comparable sales growth in the fourth quarter. Macy’s plans to expand Bluemercury with at least 30 new stores and remodel about 30 existing locations over the next three years.

The beauty chain is also testing a new store prototype featuring additional spa services, currently implemented in New Canaan, Connecticut, and Bronxville, New York.

Since its acquisition by Macy’s for $210 million in 2015, Bluemercury has grown to 159 locations as of February 4.

Leave a Reply