The U.S. Commerce Department announced today that key foreign chipmakers will continue to receive critical U.S. chipmaking tools at their China-based plants.

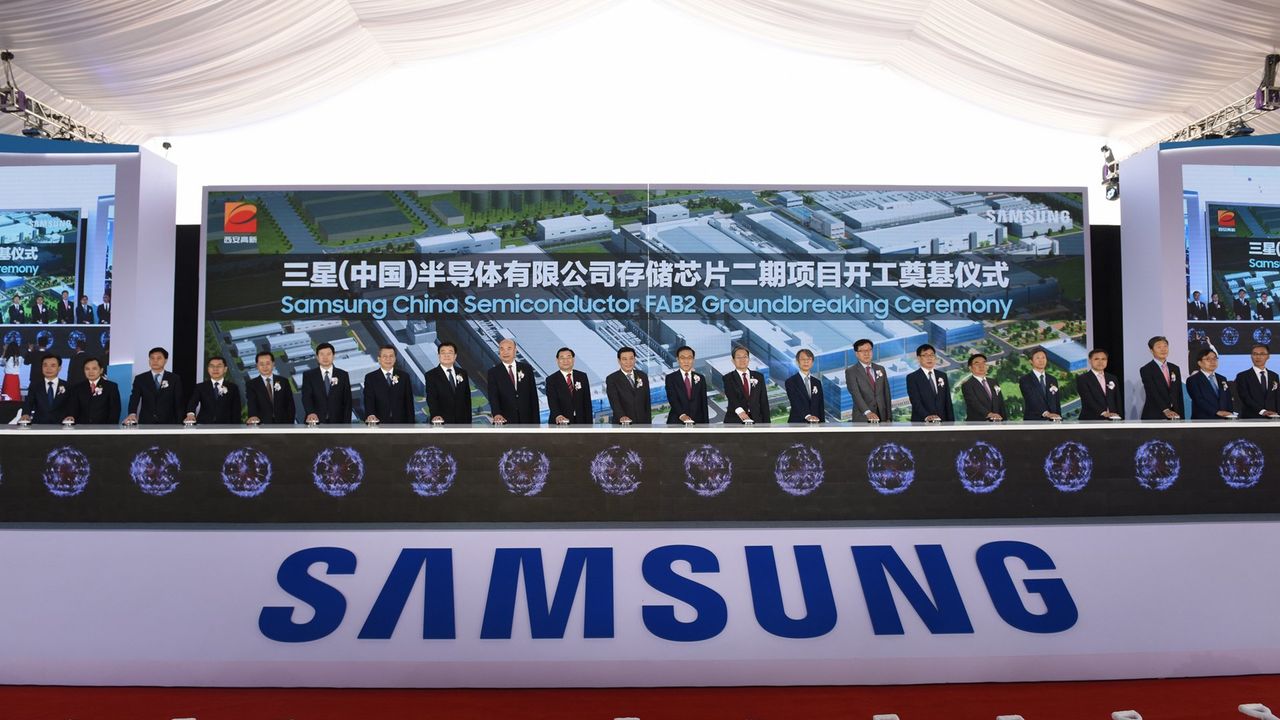

This decision extends the special authorizations previously granted to foreign chipmakers such as South Korea’s SK Hynix and Samsung, as well as Taiwan Semiconductor Manufacturing Co (TSMC).

These authorizations were initially provided after the Biden administration imposed restrictions last October on the export of advanced chips and chipmaking equipment to China.

These export controls aimed to slow China’s rapid progress in AI and military technologies. However, the new rules also had unintended consequences for U.S. chip production.

To mitigate these impacts, the Biden administration granted limited authorizations to allow some chipmakers to continue shipping equipment to China.

With the latest decision, these chipmakers will be able to maintain their operations in China without needing to apply for U.S. licenses.

In a separate report, TSMC, a critical supplier of chips for U.S. AI and military defense systems, told that it expects to receive permanent U.S. authorization for its operations in China.

The U.S. Bureau of Industry and Security has advised TSMC to apply for a “validated end-user” (VEU) authorization to ensure continuous U.S. approval for its China-based activities.

A TSMC spokesperson told, “We expect to receive a permanent authorization through the VEU process.”

The South Korean government also confirmed that Samsung Electronics and SK Hynix would be allowed to supply U.S. chip equipment to their Chinese factories indefinitely without requiring separate U.S. approvals.

This announcement from the Commerce Department comes as the Biden administration continues its efforts to restrict China’s access to AI chips.

It was reported that President Joe Biden is considering expanding export controls to close a loophole that has allowed Chinese companies to access American AI chips through overseas units, which are difficult for the U.S. to monitor.

Sources told that this loophole has enabled “overseas subsidiaries of Chinese companies” to gain “unfettered access” to restricted semiconductors, which are easily “smuggled into China or accessed remotely by China-based users.”

To address this issue, the next round of export controls may be similar to those implemented by the Biden administration in August, which restricted shipments of AI chips and chipmaking tools to some countries in the Middle East and other regions outside China.

However, it remains uncertain whether these extended restrictions will fully achieve the U.S. goal of cutting off China’s access to U.S. chipmaking tools.

Experts told that even these restrictions might overlook how easily Chinese entities can access AI capabilities remotely through cloud providers like Amazon Web Services.

Over the past year, China’s Ministry of Commerce has protested against Biden’s increasingly restrictive export controls, calling them an “unreasonable suppression of Chinese companies”.

The Biden administration introduced export controls limiting China’s access to AI technology last October, coinciding with the U.S. government’s investment of billions of dollars to expand domestic chip production.

In April, Computerworld estimated that only 12% of the world’s computer chips are produced in the U.S., marking a significant decline in U.S. leadership in global semiconductor manufacturing. Biden aims to reverse this trend with the CHIPS and Science Act, reducing U.S. reliance on foreign chipmakers.

This week, the National Institute of Standards and Technology (NIST) announced the industry leaders selected to help steer the nation’s efforts to recover from this decline.

This newly appointed board of trustees will oversee the National Semiconductor Technology Center (NSTC), which NIST described as “the core research and development (R&D) component of the Department of Commerce’s CHIPS for America program.”

“The NSTC will be a hub of collaboration for members of the entire semiconductor manufacturing and supplier ecosystem and will accelerate the pace of innovation and help lower the cost and time required to bring new technologies to market,” NIST’s announcement stated.

The board of trustees leading this initiative includes former tech industry leaders such as retired Intel Corporation CEO Craig R. Barrett, IBM veteran Nick Donofrio, former Palm Computing CEO Donna L. Dubinsky, and Robin Abrams, a former president of companies like Palm Computing and VeriFone.

They are joined by researchers, including MIT Lincoln Laboratory principal Reggie Brothers, Carnegie Mellon University professor Erica R.H. Fuchs, and Stanford University professor Jim Plummer.

“We are on a mission to bring semiconductor manufacturing back to America and secure our national and economic security, and to do that, we must continue to lead the world in semiconductor R&D,” said Secretary of Commerce Gina Raimondo in the announcement.

“The NSTC is going to supercharge chip technology and innovation ecosystems across the country so that cutting-edge developments in semiconductor design and manufacturing happen here in the U.S.”

The Department of Commerce confirmed that it expects to finalize an agreement to fund the NSTC, and NIST stated that the board of trustees would be responsible for hiring executives to manage the center.

According to Under Secretary of Commerce for Standards and Technology and NIST Director Laurie E. Locascio, once operational, the NSTC will provide the U.S. “domestic manufacturing industry with technological advances that will keep American-made products competitive.”

Locascio also noted that the NSTC would “help train the next-generation workforce to make these products in the world’s most advanced facilities,” likely alluding to delays in launching a CHIPS Act-funded Arizona chip manufacturing facility, which is reportedly partly due to a shortage of skilled labor in the U.S.

Leave a Reply